Stripe vs PayPal – Which Payment Processor Is Right for You?

As a freelancer, knowing the different features and benefits of Stripe vs PayPal is a big advantage. Stripe and PayPal are both online payment systems that are popular among freelancers, independent contractors, and remote workers. These platforms are also being used by businesses to send and receive money for any type of transaction.

Having a remote-based business means you need to have a complete online system that can fully function from sales or marketing to payment. Managing multiple projects or clients can be tricky, so you need to take advantage of technology that can help you run your business easier. This is why most business management platforms have integrated online payment systems like Stripe and Paypal so you can complete the whole duration of your project or gig in the comforts of your own home (or office).

Stripe vs Paypal: An Overview

As a freelancer, you want to avoid payment delays as much as possible, right? After all, you have to ensure that your business is in good financial standing in order to keep it going. Now that online payment processes have become accessible and generally easy for both you and your clients, it is only wise that you invest in these systems. But which one?

Stripe and Paypal are two of the best freelance payment methods. Both offer almost the same services to freelancers and businesses—focusing on easy and convenient payment processing. Plus, both platforms are internationally accepted so you won’t have a problem if your client is located in another country or continent!

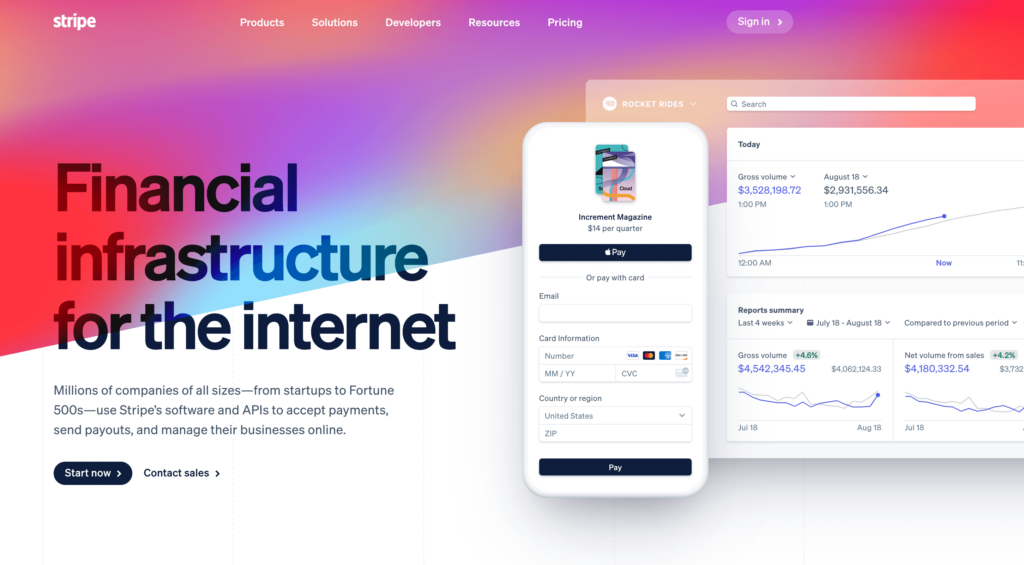

Stripe

Stripe boasts of being one of the biggest online payment solutions worldwide. It enables businesses and independent workers to receive online payments from clients using their credit cards, digital wallets, and bank transfers. If you have a physical store or office, in-person payment can also be made through Stripe’s payment terminal.

Stripe is generally free to use. What Stripe does is charge you for each completed transaction. Creating an account is also free and very easy. Once your account is verified and activated, you can already start using their invoice feature to send the billing to your client. The invoice will have a clickable payment button that will easily direct your client to the payment process. Stripe’s invoicing feature can also be used for subscription or retainer-based billing.

In receiving payments (payouts), Stripe deposits them to your registered bank account. This bank account is where Stripe will send the payments you receive. You will be able to register your bank details while you are initially setting up your Stripe account. Note that it may take two to three business days before payouts are deposited to your bank account. The first payment you process through Stripe, however, will take around seven to ten days.

Stripe lets you customize your invoices, checkout, and email receipts too. You can add your logo, icon, and accent color to brand it. Email receipts are sent to your clients once payment is successful, and Stripe Checkout is a payment page feature. Customizing your checkout page and official documents will make your business look more professional and reliable, which is absolutely perfect.

Paypal

Paypal is usually considered a digital wallet. A digital wallet is a mobile application that allows you to perform money exchange, like making purchases or shopping, using the financial information (credit card or account balance) stored in your app. Sure, you can use Paypal for that exact purpose, which is one feature of Paypal vs Stripe, but this software is more than that.

PayPal is a payment processing system that you can use to collect payments from your customers. It is an accepted payment platform worldwide, so your international clients will have no problems paying you for your services or products.

Upon signing in, Paypal will let you choose between creating a personal account or a business account. Setting up a Paypal account is free, whether it is for personal or business use. Since freelancing is considered a business, it is best to open a business account. After you fill out your business details, like your name, contact details, website, and EIN, you will be asked what you are selling. So you can choose goods, services, and others.

Next, PayPal will ask you to choose how you are going to receive your payments. Here are the choices that are available, and you can select more than one:

- your website or app

- marketplace

- invoices

- credit card (without swiping)

- Credit card (in-person)

- create a link to send to customers

You can also set if you will be paid based on single transactions, on a recurring basis, or both. And like Stripe, Paypal also has checkout and invoicing features. And like Stripe, you need to register a bank account in order to transfer your balance (payments received) to your bank account. Do note that some banks may charge fees for your transfers.

Stripe vs PayPal: Transaction Fees

Every software needs funds in order to keep its program running smoothly. And since Paypal and Stripe have waived joining fees, they get their funds for operational expenses through transaction fees. These payment processing systems bring so much convenience and efficiency to your business anyway. The next move now is to know which among these two vying for the best payment method for freelancers, has the more reasonable and practical transaction fees for your business.

| STRIPE | PAYPAL | |

|---|---|---|

| In-Person Transaction Fees | 2.7% + 5 cents | 2.29% + 9 cents |

| Online Transaction Fees | 2.9% + 30 cents | 2.9% + 30 cents |

Stripe vs PayPal: Easy Comparison

To give you a clearer guide on Stripe vs PayPal, check out the table below:

| Stripe | PayPal | |

|---|---|---|

| Business Type | Freelancers, Independent Contractors, Consultants, Coaches, Small to Medium Businesses, Best for Enterprises, and larger corporations | Enterprises, and larger corporations Best for Freelancers, Independent Contractors, Consultants, Coaches, Small to Medium Businesses, |

| Usability | A little more complicated than PayPal | Easy to Use |

| Internationally Accepted | Yes | Yes |

| Invoicing and Billing | Yes | Yes |

| Reports and Analytics | Yes | Yes |

| Transaction Fees | Simple | More complicated than Stripe |

| In-Person Payments | Yes | Yes |

| Ecommerce/Checkout Payments | Yes | Yes |

| Customer Support | Yes | Yes |

| Other Software Integrations | Yes | Yes |

Choosing the Right One for You

It is true that payment processing platforms typically have the same features. These business solutions vary mainly in usability and how they charge for their services, like in the case of Stripe vs PayPal. So, how do you choose the right one for you? Here are a few factors to consider:

- Usability. Check the platform on how easy it will be for you to navigate the interface and its systems. Of course, everyone wants an easy, sort of like a point-and-click method because as freelancers, you do not really have time for software with steep learning curves.

- Practicality. Review the features and costs (fees) very well. If you are more of a local freelancer, then you do not need a platform that is designed for international transactions. You can choose the simpler one. Similarly, know the transaction fees for international payments and currency adjustments if you have foreign clients. See which ones have features and fees that best suit your business.

Conclusion

Technology has paved the way for smoother and more efficient management of businesses. Whether you are a solopreneur or a small business owner, there are online business solutions right for you. What’s amazing about these platforms is that it streamlines all your business processes from start to finish. Payment processing has become a breeze. No need to run to the bank to deposit checks anymore!

With all the available platforms, Stripe and PayPal take the top spots. With their software integrations, international payment capabilities, and other financial infrastructure features, you can never go wrong with these two. Choosing the right one for you depends on how much you are willing to pay for charges and fees and how easily you can navigate the platform. So in deciding between Stripe vs PayPal, you simply have to see which one feels right for you.

Get Organized & Win More Clients

Kosmo has everything you need to run your freelancing business.