Invoicing Software for Auditors

Transform your invoicing experience and speed up the payment process with Kosmo. As an auditor, you’ll swiftly send out invoices, monitor payments, and effortlessly manage your financial matters.

Invoicing for Auditors with Kosmo

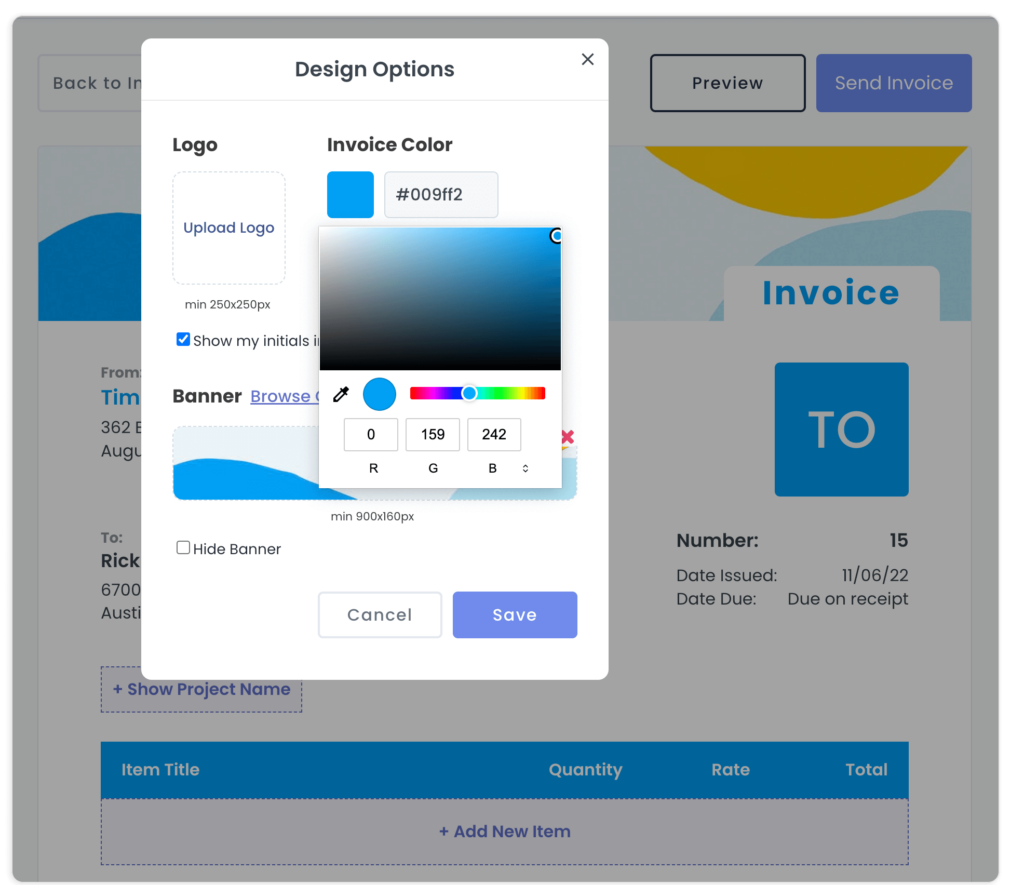

Effortlessly manage your auditing firm’s invoicing process with Kosmo’s streamlined features. Designed specifically for professionals who value both accuracy and efficiency, Kosmo complements your meticulous approach to auditing by providing a simple and reliable invoicing solution. With the platform’s customization features, you can create professional-looking invoices that reflect your firm’s brand and include detailed descriptions of the auditing services you rendered. As a result, you can expect greater transparency and client satisfaction, which ultimately translates to better on-time payments.

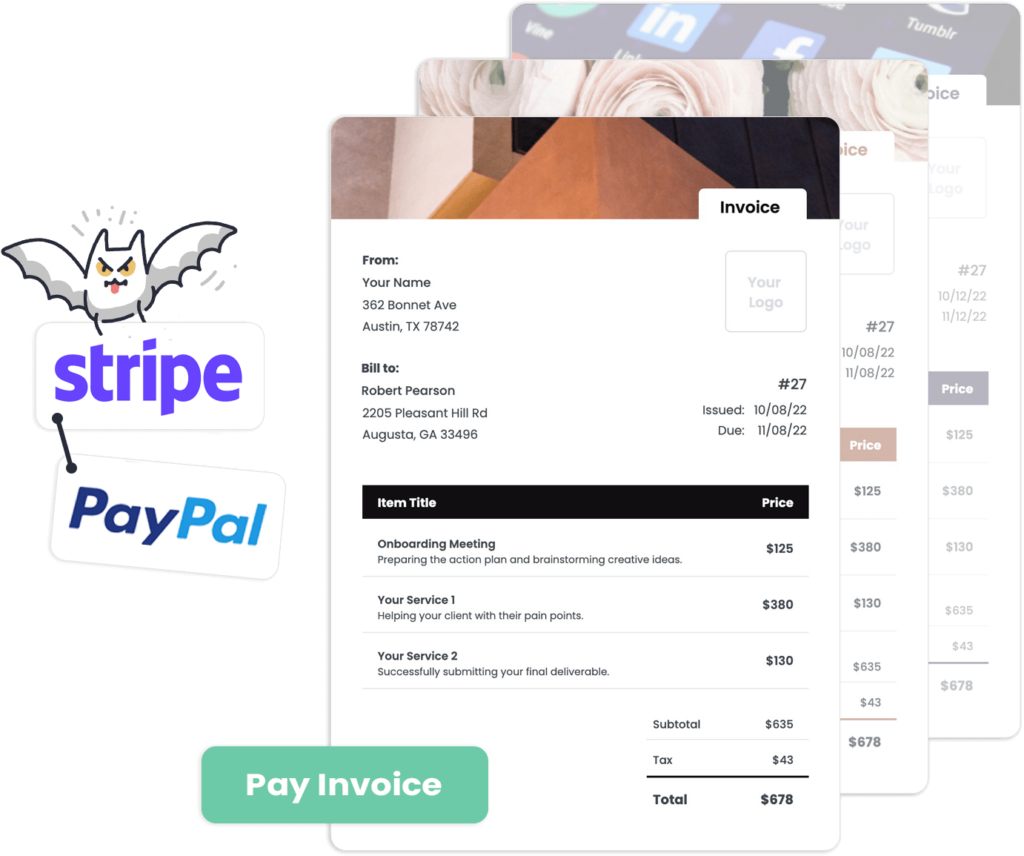

Moreover, Kosmo’s expense tracking capabilities enable you to manage your auditing-related expenses effortlessly. By assigning specific costs to individual projects, your firm can maintain a comprehensive and organized record of financial transactions, while also ensuring that client invoices are accurate and up-to-date. With Kosmo’s seamless integration with Stripe and PayPal, you can conveniently receive client payments and manage overdue invoices— allowing your auditing firm to stay ahead of the competition and wholly focused on delivering exceptional services.

Create Professional Looking Invoices

Design invoices that match your brand and style. With Kosmo, you can customize your invoices with your logo, banner and colors.

Get Paid Faster Via Credit Card and ACH

No more waiting for checks. Get paid via credit card and ACH. Kosmo also keeps track of all your payments in one place.

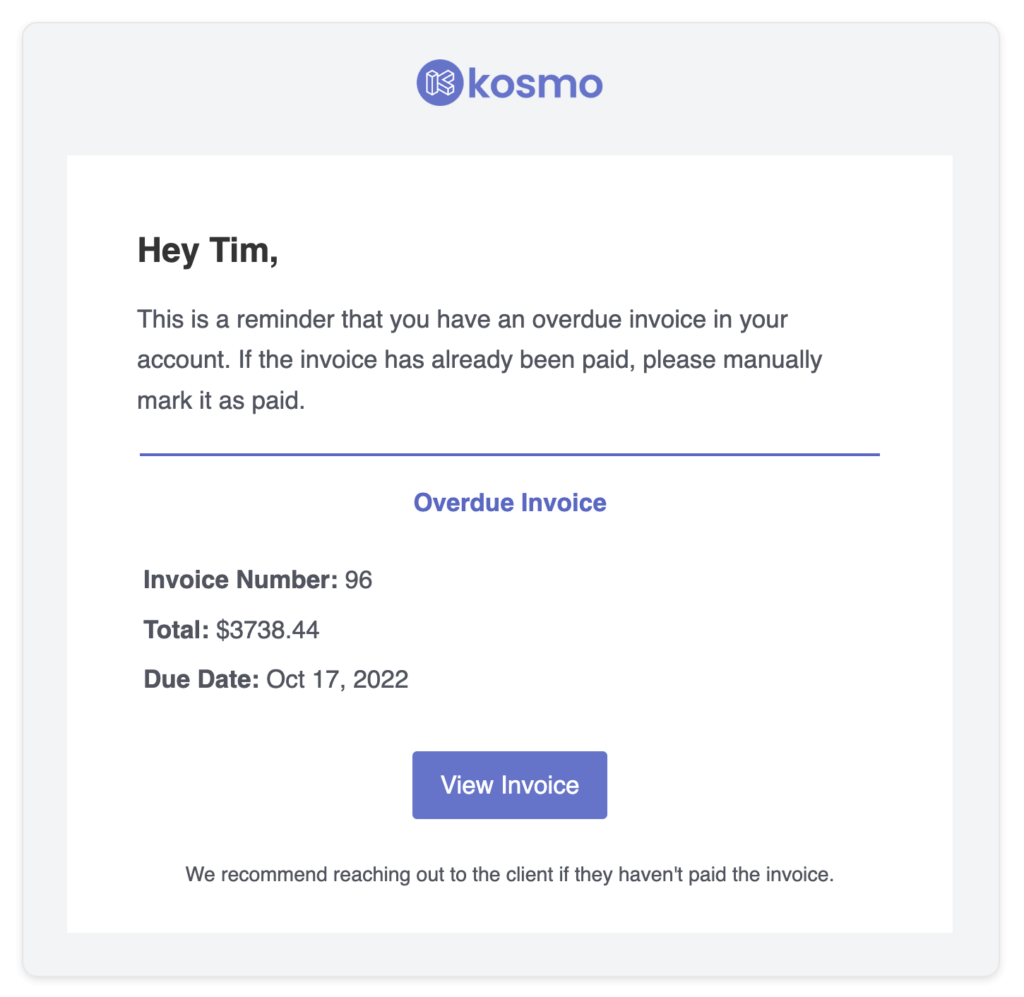

Never Forget About an Invoice

With automatic reminders, you’ll always know when a payment is due. Stay on top of your finances and get paid on time, every time.

Why Do Auditors Need Invoicing Software?

One of the main reasons auditors need invoicing software is to streamline their financial processes. Efficient invoicing and billing can significantly reduce the time spent on manual tasks, such as creating invoices, monitoring payments, and managing clients’ accounts. By leveraging modern invoicing software, auditors can quickly create, send, and track invoices, ensuring accuracy and consistency across their financial records.

Furthermore, invoicing software can help auditors improve their clients’ overall financial management. It allows for better communication between auditors and clients, as well as easier access to financial documents and reports. For example, software with customizable templates can produce professional and branded invoices that reflect the auditor’s business identity, further enhancing the client’s trust. Additionally, software with multi-currency and multi-lingual support can expand their reach to clients globally, making invoicing more accessible and efficient for both parties.

What Are The Benefits?

Invoicing software offers notable advantages for auditors as they ensure accuracy, efficiency, and allow easy monitoring of transactions. Accurate invoicing is essential for auditors, and using software eliminates human error, showing a clear picture of financial information. The automation provided by invoicing software also removes the need for manual calculations and double-checking, saving valuable time and reducing the potential for costly mistakes.

Another significant benefit for auditors is the ease of tracking and organizing invoices. Invoicing software provides a centralized platform for managing all financial records, enabling auditors to assess and analyze transactions effortlessly. Since the software maintains an organized and searchable database, it becomes more straightforward for auditors to review past invoices and identify irregularities, discrepancies, or patterns in financial transactions.

Beyond accurate financial records and effortless organization, invoicing software also enhances the level of security in payments and financial data. Many invoicing platforms comply with industry standards and encryption protocols, ensuring that sensitive payment and financial information is protected from unauthorized access and fraud. This level of security gives auditors peace of mind, validating the integrity and reliability of the invoicing process.

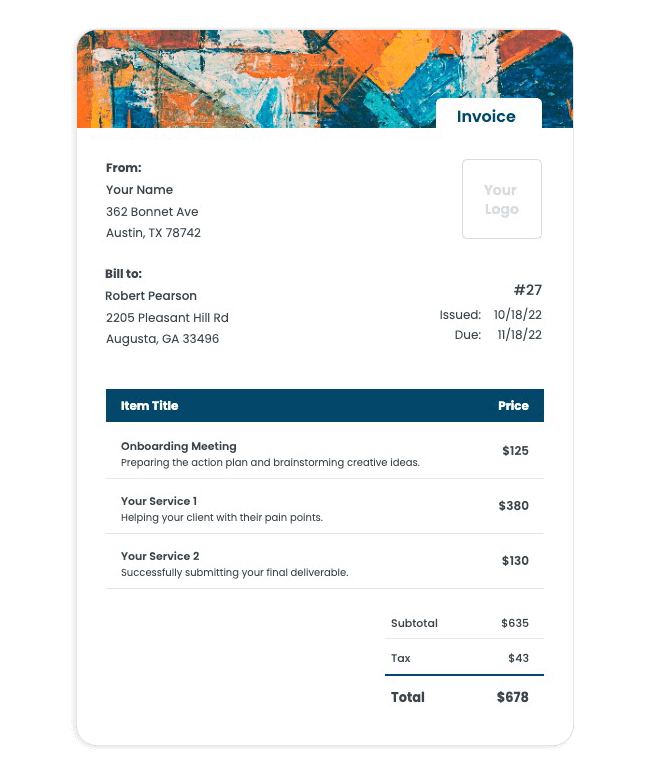

Invoice Templates

Eager to craft an invoice that ensures timely payment for your auditing services? Kosmo makes it a breeze to whip up polished, expert-looking invoices tailored to your freelancing requirements.

Take your pick from our no-cost invoice templates, inject your unique branding, and be sure not to leave out any key information such as payment terms and how to reach you. With Kosmo, sending your invoice online accelerates payment, thanks to automated reminders for tardy clients.

Get paid on time,

every time.

Create professional invoices with Kosmo and level up your business today.

What payment options work with Kosmo?

Kosmo offers a seamless payment experience for its users by integrating with two popular payment processors: Stripe and PayPal. With these integrations in place, users can conveniently process payments via credit and debit cards. This compatibility ensures a smooth, hassle-free checkout process.

Additionally, Kosmo understands the need for versatility and allows users to add custom payment options. By doing so, businesses can cater to their specific needs and create a more tailored, personalized experience for their customers.

Does this really save time?

Invoicing software significantly streamlines the work of auditors, allowing them to focus more on their core competencies by eliminating the manual tasks associated with invoicing. Automated invoicing tools provide an organized and centralized database for storing invoices, making it easier for auditors to access and track relevant information. They also offer features like templates, automated reminders, and tracking of payment statuses, which further reduces the time auditors spend on tracking down unpaid invoices and managing overdue accounts.

Another vital aspect of invoicing software that saves time for auditors is the integration with other financial software, such as accounting and tax systems. This allows for seamless data transfer between platforms, automating the reconciliation process and ensuring that all financial data is accurate and up-to-date. By streamlining these processes, auditors can spend less time sorting through paperwork and manually adjusting records, resulting in a more efficient audit process and accurate financial reporting.

Who should use invoicing software?

Invoicing software is a valuable tool for business owners, freelancers, and contractors who manage their own billing processes. Choosing an invoicing system allows small businesses and entrepreneurs to keep track of payments, organize their finances, and reduce the potential for errors. In addition to streamlining these tasks, users will often benefit from features such as automatic reminders, customizable invoice templates, and integration with other financial software.

In particular, service-based businesses – like consultants, graphic designers, and marketing agencies – often rely on invoicing software to bill their clients. However, anyone who needs to keep tabs on their income and expenses can benefit from an invoicing system. Ultimately, using invoicing software not only saves time but also adds professionalism to a company’s billing practices, making it an essential consideration for a wide range of enterprises.