Invoicing Software for Risk Managers

Speed up that cash flow, Risk Managers! Kosmo empowers you to whip up invoices in a flash, keep tabs on those payments, and maintain total control over your financial situation.

Invoicing for Risk Managers with Kosmo

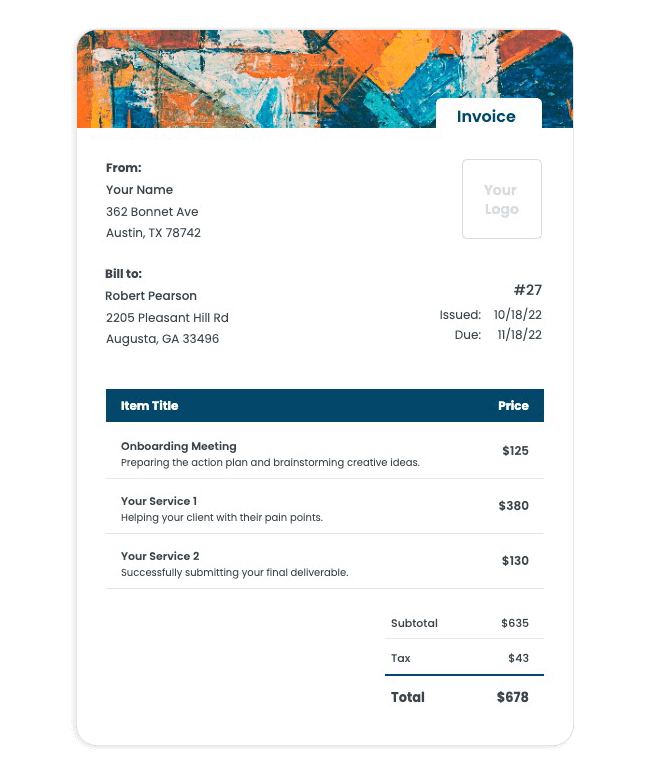

Simplify invoicing for risk managers like never before with Kosmo’s intuitive and robust invoicing capabilities. Kosmo understands the unique needs of risk management professionals, and its customizable invoicing feature allows you to create professional-looking invoices with ease. With the ability to add item descriptions, automatically import previously tracked time, and incorporate your own logo and banner, you will impress your clients and ensure timely payments.

Plus, Kosmo’s comprehensive platform offers so much more than just invoicing. As a risk manager, you can streamline your business and make managing your administrative tasks a breeze. From project management and expense tracking to proposal and contract management, Kosmo provides all the necessary tools to help you stay organized, meet deadlines, and maintain positive client relationships. It’s time to upgrade your invoicing game and elevate your risk management business with Kosmo.

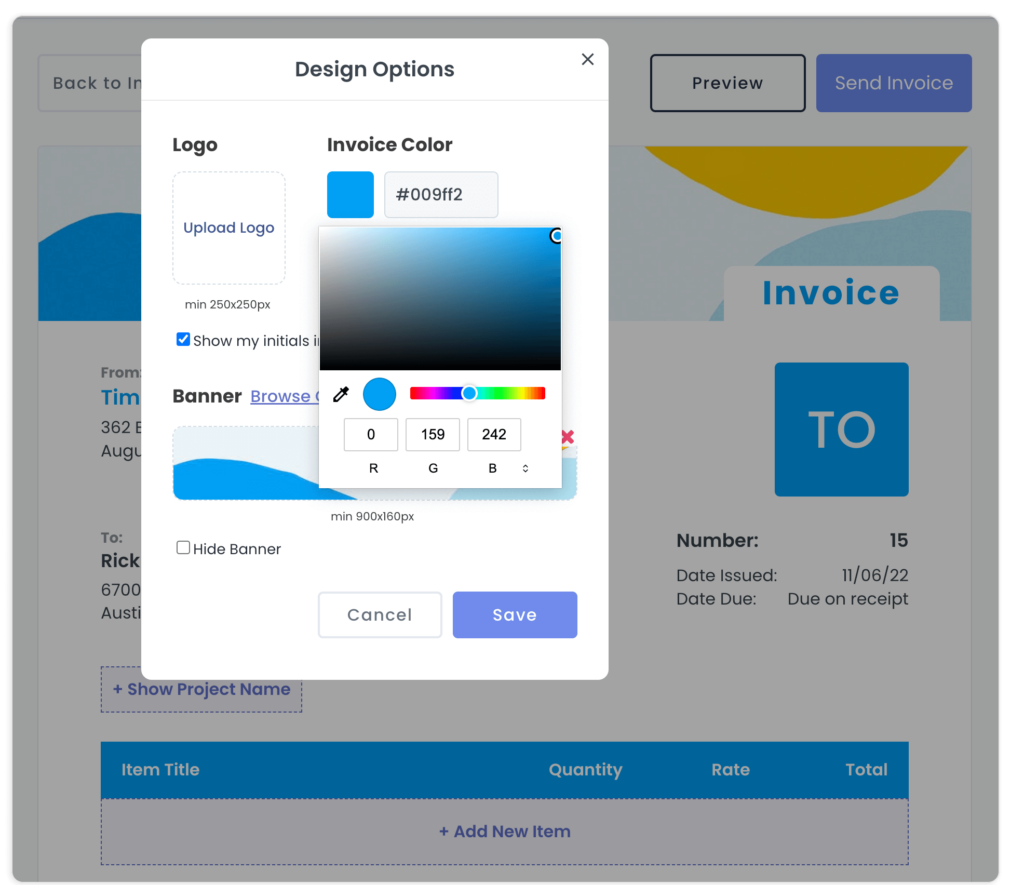

Create Professional Looking Invoices

Design invoices that match your brand and style. With Kosmo, you can customize your invoices with your logo, banner and colors.

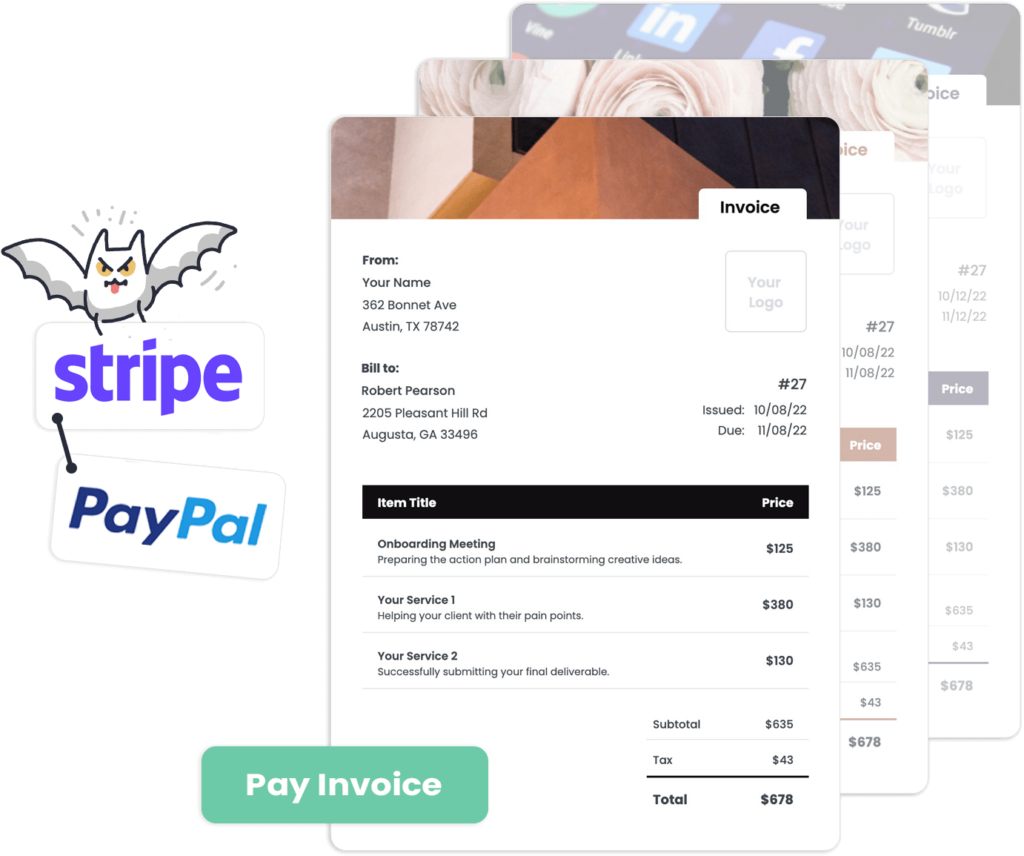

Get Paid Faster Via Credit Card and ACH

No more waiting for checks. Get paid via credit card and ACH. Kosmo also keeps track of all your payments in one place.

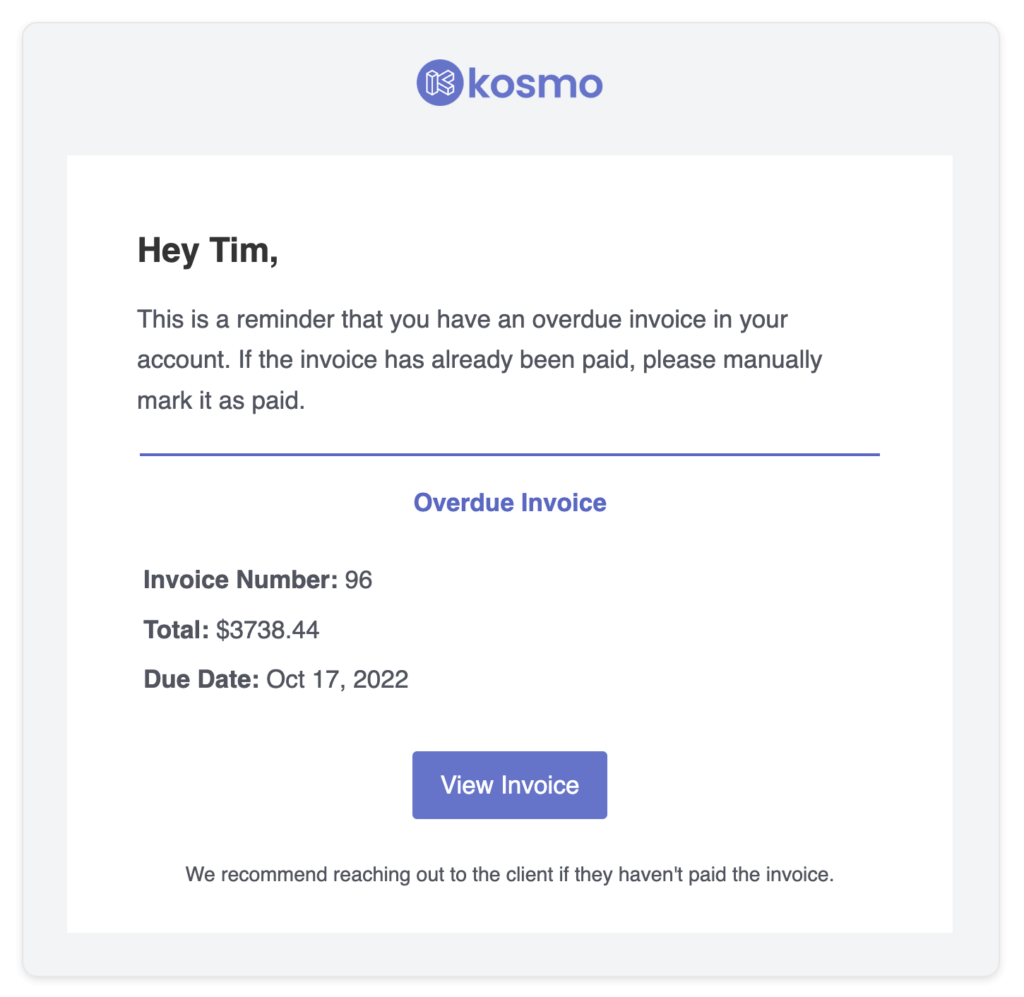

Never Forget About an Invoice

With automatic reminders, you’ll always know when a payment is due. Stay on top of your finances and get paid on time, every time.

Why Do Risk Managers Need Invoicing Software?

In the world of risk management, invoicing software plays a crucial role in streamlining operations and improving overall efficiency. As risk managers need to keep track of multiple clients and expenses, a comprehensive invoicing system not only simplifies their workflow but also enhances the accuracy of their financial management.

Furthermore, invoicing software allows risk managers to easily track outstanding payments, generate customized reports, and integrate with other accounting software platforms, reducing human error and ensuring compliance with customizable tax and regulation requirements. With easy-to-use automated features, this crucial tool can help risk managers save time and resources, allowing them to focus on their core competencies in evaluating and mitigating risks for their clients.

What Are The Benefits?

Invoicing software has numerous advantages for risk managers, streamlining their workflow and simplifying the financial processes of their organization. One significant benefit is the improvement in cash flow management. With automated invoicing systems, risk managers can track payments, monitor outstanding invoices, and quickly identify potential financial concerns. These insights can help them make informed decisions to mitigate risks and ensure the business’s financial stability.

Another crucial aspect of invoicing software for risk managers is the enhancement of data accuracy and reduction of human error. Manual invoice processing can lead to inconsistencies and erroneous data entries, which can compromise the organization’s financial health and increase risks. Implementing invoicing software minimizes the chances of such errors by automating data entry and validation processes while allowing risk managers to focus on more strategic tasks.

Lastly, invoicing software facilitates regulatory and financial compliance, which is a high priority for risk managers. These systems often come with built-in tax calculation features that adhere to current tax regulations and customizable invoice templates that incorporate essential legal and financial details. This level of compliance not only reduces the chances of costly disputes and penalties, but also helps risk managers maintain their organization’s reputation and integrity in the marketplace.

Invoice Templates

Want to know the secret to crafting an invoice that ensures timely payment for your freelancing work? Look no further than Kosmo – the go-to invoicing solution for Risk Managers like you!

Just select from our assortment of free invoice templates, personalize it with your own branding, and don’t forget to include those crucial details like payment terms and contact info. Once you hit send on that online invoice, you can sit back and relax, knowing Kosmo’s got your back with automatic late payment reminders to help you get paid even faster!

Get paid on time,

every time.

Create professional invoices with Kosmo and level up your business today.

What payment options work with Kosmo?

Kosmo caters to various payment preferences by allowing users to process payments via both Stripe and PayPal. These popular platforms enable the acceptance of credit cards and debit cards, offering ease and security for online transactions. As a result, Kosmo efficiently accommodates the needs of diverse clientele through its system.

In addition to these established payment gateways, Kosmo users have the flexibility to add custom payment options. This feature ensures that they can provide their clients with a tailored experience, further expanding the range of available choices to suit individual requirements. With the ability to effortlessly integrate various payment methods, Kosmo proves to be a versatile platform for users and their clients.

Does this really save time?

Invoicing software streamlines the billing process for risk managers, significantly reducing the time spent on manual tasks. By automating invoice generation, tracking, and reconciliation, risk managers can focus on their core responsibilities, such as identifying and mitigating potential risks. Customizable templates and built-in currency and tax calculators enable quick and accurate invoicing, ensuring that clients receive timely and accurate bills, fostering positive relationships and improved cash flow management.

Moreover, invoicing software enhances data analysis and reporting by consolidating billing information in one central location. This allows risk managers to easily access crucial financial insights, monitor outstanding invoices, and evaluate the overall efficacy of their billing process. Consequently, this improved oversight not only saves time but also aids in identifying opportunities for further optimization and growth in their practice.

Who should use invoicing software?

Invoicing software has emerged as an indispensable tool for a wide range of individuals and businesses owing to its numerous advantages. Freelancers, for example, can benefit greatly from automated invoicing systems as they help streamline the billing process, allowing them to focus on their core tasks and skillset. Invoicing software is particularly useful for freelancers who have multiple clients, as the software simplifies tracking of payments, setting up payment reminders, and assessing financial performance.

Additionally, small and medium-sized businesses can leverage invoicing software to reduce manual tasks and errors that come with traditional billing methods. The software can be tailored to suit the company’s specific needs, including customizing invoices, managing client databases, and monitoring revenue streams. With the ability to track invoices, set up recurring bills, generate financial reports, and integrate with other accounting software, invoicing software has become a necessity for businesses looking to optimize their financial operations.