Invoicing Software for Tax Advisors

Speed up your payment process and keep your finances in check, Tax Advisors. With Kosmo by your side, you can effortlessly send out invoices, monitor payment progress, and maintain an organized financial record.

Invoicing for Tax Advisors with Kosmo

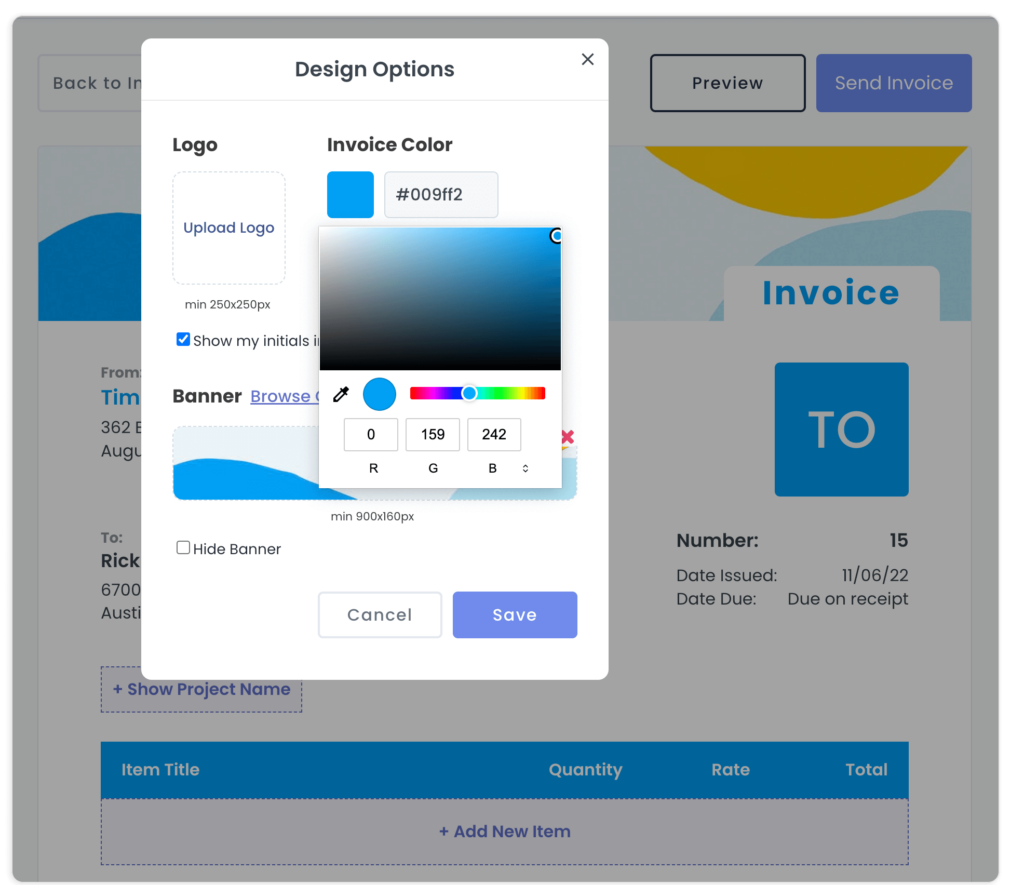

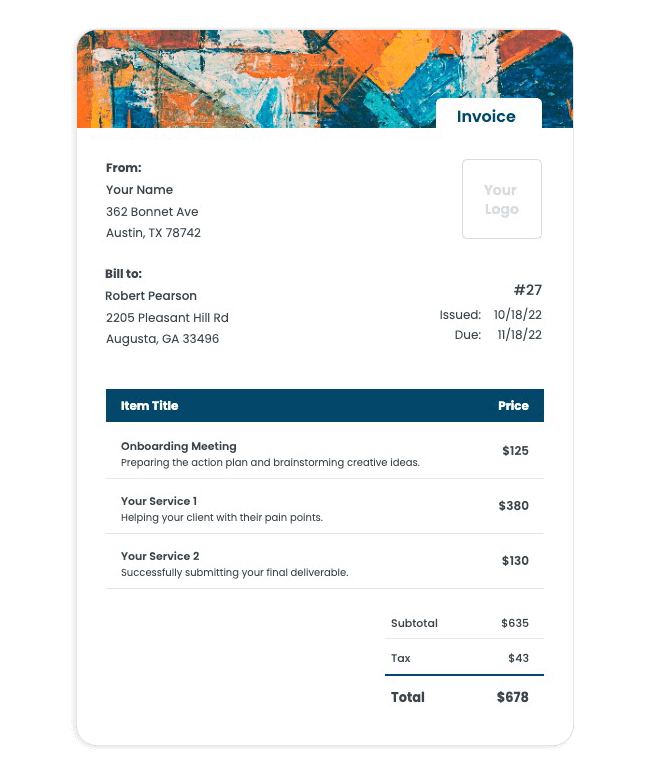

Efficient invoicing is crucial for tax advisors, as it reflects the professionalism and accuracy that clients expect from experts in the financial field. Kosmo simplifies the process by offering user-friendly invoicing features that cater specifically to the needs of tax advisors. Customizable with your own logo and banner, Kosmo’s invoices combine a polished appearance with precise item descriptions and automatically tracked billable hours, ensuring your clients receive timely, well-documented bills.

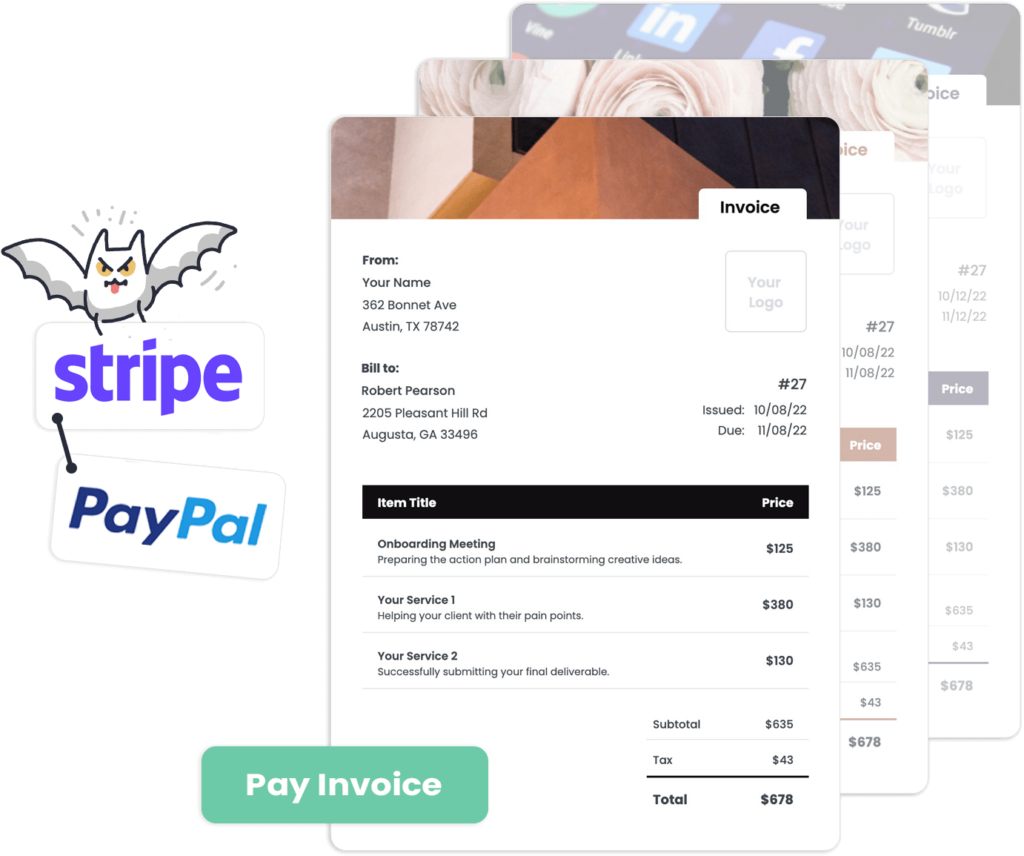

Beyond aesthetics, Kosmo’s powerful platform keeps you in control of your finances with expense tracking capabilities, letting you easily assign expenses to specific projects. Furthermore, integrating Stripe or PayPal into the payment processing feature allows for seamless transactions, while automated reminders for overdue invoices make certain that your cash flow remains steady. By using Kosmo, tax advisors can demonstrate their commitment to excellence in every aspect of their business, from client management to project completion and invoicing.

Create Professional Looking Invoices

Design invoices that match your brand and style. With Kosmo, you can customize your invoices with your logo, banner and colors.

Get Paid Faster Via Credit Card and ACH

No more waiting for checks. Get paid via credit card and ACH. Kosmo also keeps track of all your payments in one place.

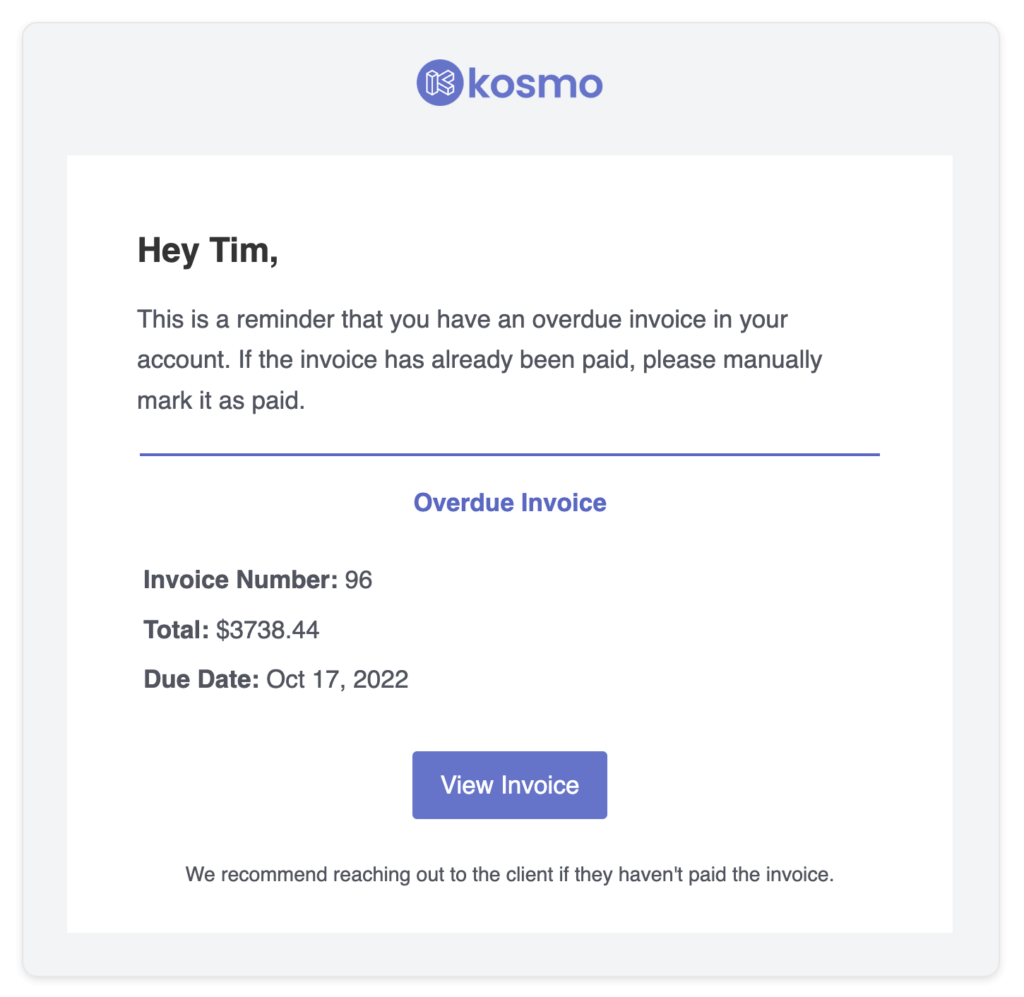

Never Forget About an Invoice

With automatic reminders, you’ll always know when a payment is due. Stay on top of your finances and get paid on time, every time.

Why Do Tax Advisors Need Invoicing Software?

Tax advisors are faced with a multitude of tasks and responsibilities, making it crucial to have an efficient system in place to manage invoicing processes. Invoicing software plays a key role in streamlining this process by providing an accurate and effective method of invoicing clients. With the ability to automate, track, and customize invoices, tax advisors can save significant time and effort, allowing them to focus on their core competencies of providing tax advice and planning services.

Additionally, invoicing software provides essential features such as tax compliance management, financial reporting, and integration with various accounting systems. For tax advisors, ensuring that invoices meet stringent tax regulations is paramount. Invoicing software allows for easy application of appropriate tax rates and regulations to invoices. Furthermore, it facilitates advanced reporting capabilities, allowing tax advisors to have a clear understanding of their financial data and making it simpler to assess the health of their business. This combination of efficiency, accuracy, and compliance makes invoicing software an indispensable tool for the modern tax advisor.

What Are The Benefits?

Invoicing software offers several benefits for tax advisors, streamlining their invoicing and financial management processes. One major advantage is the automation of invoice generation, tracking, and payment collection. This not only saves time and effort, but also reduces the risk of human error. Tax advisors can easily keep track of their clients’ payments, set up recurring invoices for ongoing services, and send payment reminders. This efficiency allows them to focus on providing quality tax advice to their clientele.

Another significant benefit is the advanced reporting and analytics features that most invoicing software platforms provide. These tools help tax advisors monitor key metrics, such as revenue, outstanding payments, and client activity. With access to real-time data and customizable reports, tax professionals can better evaluate their business performance and develop strategies for future growth. Furthermore, these insights can also be valuable in assisting their clients to maintain optimal financial health.

Invoicing software also facilitates secure and seamless integration with other business tools, such as accounting and customer relationship management (CRM) systems. This centralization of data simplifies the tax filing and auditing processes, ensuring that tax advisors have accurate and up-to-date financial information when assisting their clients. Additionally, the enhanced data security measures employed by many invoicing software providers protect sensitive client information and help tax advisors maintain compliance with regulatory requirements.

Invoice Templates

Wondering how to whip up an invoice that ensures speedy payment for your tax advisory services? Kosmo has got you covered! We make it a breeze to craft stunning, professional invoices designed for freelancing work in the tax industry.

Simply pick from one of our complimentary invoice templates, amp up its charm with your unique branding, and incorporate vital info like your payment policies and contact details. Sending your invoice online is a cinch – plus, the automatic late payment reminders will help you get paid in no time!

Get paid on time,

every time.

Create professional invoices with Kosmo and level up your business today.

What payment options work with Kosmo?

Kosmo offers a variety of payment options for its users, designed with flexibility and convenience in mind. By integrating with popular payment processing services, it ensures seamless transactions for both merchants and their customers.

The primary payment options that work with Kosmo are Stripe and PayPal. These platforms enable users to process payments via credit cards and debit cards without any hassle. Additionally, Kosmo allows users to add custom payment options, ensuring that businesses can tailor the payment experience to meet their specific needs.

Does this really save time?

Invoicing software streamlines the billing process for tax advisors, enabling them to save valuable time and effort. By automating repetitive tasks like invoice creation, tracking, and follow-ups, such platforms facilitate efficient management of client billing and payments. These software solutions also help to prevent human errors that might occur in manual invoicing, ensuring that tax advisors generate accurate invoices every time.

Additionally, invoicing software often integrates with other business tools like accounting and time-tracking applications. This assists tax advisors in maintaining up-to-date financial records and gaining insights into their clients’ payment history. As a result, they can focus more on delivering quality tax advisory services and growing their practice, rather than getting bogged down by administrative tasks.

Who should use invoicing software?

Invoicing software is a valuable tool for a wide range of professionals and businesses. Freelancers, for example, can benefit from using invoicing software to track their billable hours, manage their expenses, and send detailed invoices to clients in a timely manner. Having a reliable invoicing system in place streamlines the administrative side of freelancing, allowing the freelancers to focus on their core work.

Small to medium-sized business owners can also take advantage of invoicing software to better manage their cash flow, process payments, and communicate with clients. The software often integrates with existing accounting systems or business platforms, simplifying data entry and ensuring accurate financial records. By using invoicing software, businesses can minimize errors, project a professional appearance to clients, and ultimately save time and money.