Does Rover Take Out Taxes? How to Work With the Platform

Does Rover take out taxes? Are you an aspiring dog or cat sitter who wants to join Rover but is curious about the tax policies of the platform?

First of all, you are doing a good job of being a responsible freelancer (and citizen) if you are thinking about your tax obligations this early on. This attitude will really save you from headaches and stress come tax season. Clearly, you are passionate about your profession, and all we can say is: Keep it up!

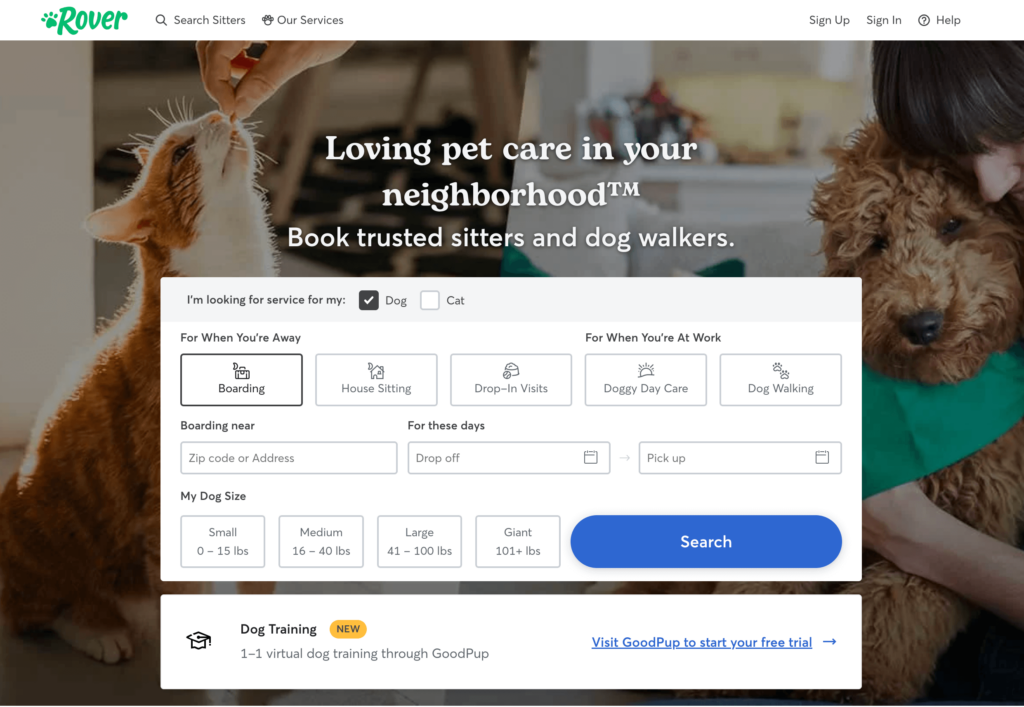

What is Rover?

Rover is an online platform for pet owners and sitters to connect. It is like a buy-and-sell marketplace for pet care like sitting, boarding, and dog walking. The site connects pet owners with nearby sitters who are passionate about giving love and care to dogs and cats. Rover offers the following services to pet owners:

- Boarding. Sitters take in pets to stay with them overnight.

- House Sitting. Sitters will stay in the owner’s house to take care of both the pets and the house.

- Dog Walking. The classic dog-walking gig.

- Doggy Day Care. Sitters will take in pets to stay with them for a day.

- Drop-In Visits. Sitters drop in the owner’s home to play with the pets and provide pet care.

- Dog Training. A virtual, private dog training session with an expert dog trainer.

Rover is a big online marketplace and can provide pet care services throughout the United States, Canada, and major countries in Europe.

Becoming a Sitter in Rover

Before we discuss the concern, “Does Rover take out taxes?” Let’s talk about how you can join Rover first.

If you really have a passion for taking care of animals, especially dogs and cats, then Rover might be a good place for you. Not only will you be playing and providing pet care for the furry ones, but you will also earn from it too. Sounds fun, right? So, how do you become a sitter in Rover?

- Go to their website, Rover.com, and choose Become a Sitter. From there, simply click on “Get Started.”

- Select which of the services you are interested in providing (Boarding, House Sitting, Dog Walking, Doggy Day Care, Drop-In Visits). You can choose more than one, then click “Save and Continue.”

- You will be asked to complete the next section, which discusses more about you, your experiences and background, and how you will be providing service. This is where you will be asked about your rates (Rover adds service fees for sitters, so be strategic with your rates) and to complete a background check. There is a safety quiz too that you need to pass.

You will be notified via email if your application is approved or if there are any concerns about your submission. After a successful application, you will now be listed as one of the sitters in Rover. Pet owners who wish to acquire services that you provide will see your profile once they start the search. Remember that there are other sitters in Rover too, so you have to make sure that you have an excellent profile in order to stand out.

Does Rover Take Out Taxes

One thing you have to keep in mind is that being a registered sitter for Rover doesn’t make you their employee. Rover is just a platform giving you opportunities to market your service. Sort of like a super high-tech bulletin board. Basically, you still fall under the self-employed category of worker and are therefore responsible for your own tax obligations.

So, if you are wondering, “Does Rover take out taxes?” the answer is NO.

While Rover doesn’t take out taxes, you still have to file appropriate tax obligations to your country’s tax collecting agency. So, as a freelancer, you have to make sure you have your tax ID number. You might ask then if Rover can provide you with the necessary tax documentation, like 1099 or its variant, 1099-K.

Rover has several guidelines when it comes to the 1099 and 1099-K forms. If you received more than $600 in gross payments for services booked on Rover’s platform in a year, and only if you received those payments through Stripe, Rover will send you a copy of the 1099-K. You may opt to receive the form electronically or through the mail.

For the 1099 form, some factors affect this process, such as your location, methods of receiving payments, and the amount of payments processed by Rover on your behalf. For instance, if you preferred to receive payments via Paypal, Paypal will be the responsible party for your taxation documentation. Don’t worry; to help you with filing your tax return, Rover will provide you with an annual earnings summary.

Pro Tip: Use freelance software tools to help you manage your sitting business efficiently.

Conclusion

It may be fun to work with people, but working for pets is definitely more exciting and heart-warming. If you love playing and taking care of dogs and cats, then you must definitely be on Rover. Imagine, you get to have fun with different breeds of fur babies and get paid for it!

Now that you know the answer to the question, “Does Rover take out taxes?” you can easily plan your accounting duties and focus more on the adorable pets you will get to be with!

Get Organized & Win More Clients

Kosmo has everything you need to run your freelancing business.