Freelance Translation Taxes – What You Should Know

There is no easy way to know the freelance translation taxes you need to pay throughout the year. Each freelancer has different earnings and also various setups with clients. There are a number of factors that can affect the freelance translation taxes that you will need to pay.

This is one of the things a freelancer needs to deal with that an employed translator doesn’t have to do. As a freelancer, you pretty much have to do everything—and yes, that includes doing your own taxes and accounting. Of course, you can always hire someone else to do this but if you are just starting out, or have no means to pay for a pro, you have to do it yourself.

It’s a good thing there are now resources you can check out on the internet regarding freelance translation taxes—including this one. Even with Google Translate and other translator apps around, there’s still a high demand for human translators. Translation is a major industry as it helps remove barriers from one language to another. It’s an art form in itself to find words that have the same meaning in another.

According to research, the translation service market industry will become a billion-dollar industry by 2030. It’s highly possible that the demand for translators will increase in the following years too. Freelancers who want to make bank should be setting up their business as early as now—and this includes fixing their freelance translation taxes also.

Factors that Affect Freelance Translation Taxes

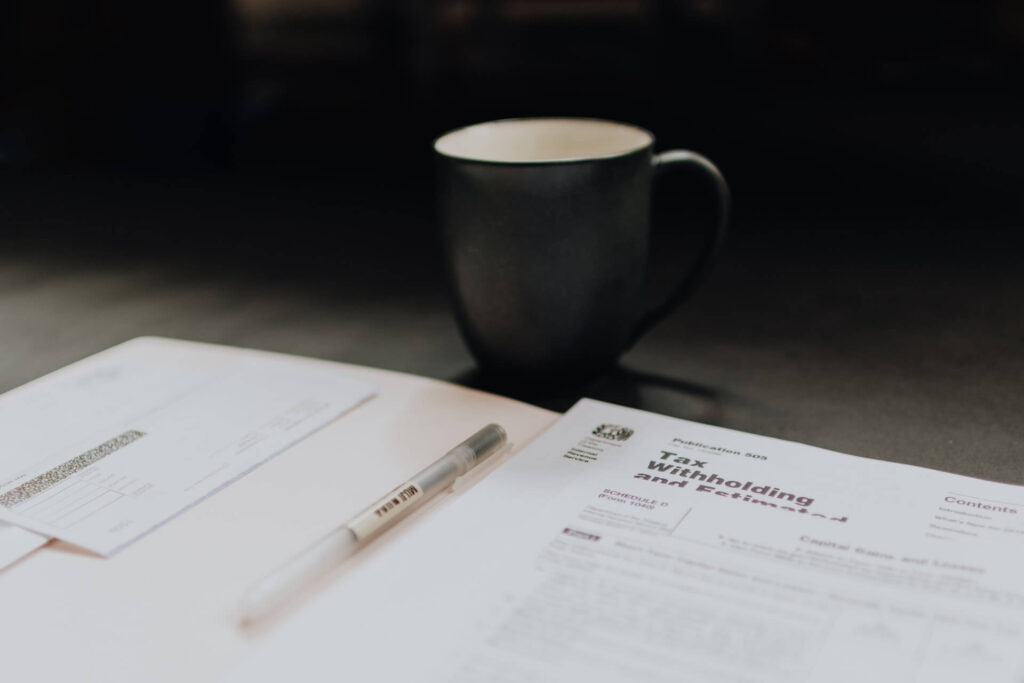

If you have never handled taxes before, then you’re going to need some help. The good thing is, once you acquired the right information, you should have an easier time come every tax season.

1. Your Tax Laws

The number one thing you need to consider for freelance translation taxes is the law where you currently reside or do business. This is where you will find out what is the structure of the government, what are the rules, which of your projects will be taxed, your bracket, and so on.

You will definitely need to know anything and everything about freelance translation taxes in the country where you operate. Freelancers are required to pay taxes too.

2. Tax Category

The next thing you need to figure out is your tax category. Are you currently self-employed? Or do you have an LLC? Self-employed freelancers and freelancers operating as an LLC have different tax rules. There are even freelancers that have a unique setup with a client wherein the client may handle your taxes on their end (but this is quite rare).

The point is, you need to know your tax category so you know which rules to follow. It will also be easier to get help from others who fall under the same tax category as yourself.

3. Amount of Money Earned

Not having a fixed income is one of the distinguishing features of being a freelancer. This can be a good thing or a bad thing, depending on how much your earnings fluctuate throughout the year. This is also the reason why computing your taxes isn’t as easy. This isn’t like being an employee where you get a fixed amount of money every month.

Of course, this can be exciting too because there is no ceiling as to how much you can actually earn per year. But with that, you’re going to need to keep track of your income from all projects and clients so that you’ll have an easier time computing your taxes.

4. Tax Deductible Expenses

Depending on the revenue agency of your country, freelancers (self-employed or LLC) may have business deductible expenses. These are expenses from your company that entitles you to reduce the amount of taxes that you need to pay, such as mileage log taxes. If you use PayPal, there are fees that can also be tax deductible.

5. Clients

It’s pretty common for freelancers to work with clients that are somewhere else across the globe. If this is the case, check the laws of where your client is located. There may be a chance that you are working for a client who lives in a different country which will exempt you from certain taxes.

Tips for Freelance Translators

Taxes can get very confusing as a freelance translator. After all, numbers really aren’t your forte. Here are some tips that can help you out with freelance translation taxes:

• When in doubt, ask

If there is something you are not sure of when you are doing your taxes, always ask and never guess. Check out online resources from your revenue government agency. If there is a helpline, do utilize that. It’s better to ask than to face tax penalties for doing something wrong.

• Check your last year’s tax

If you’ve been in the freelance industry for a while, you can always refer to your past taxes. This will give you a better estimate of your taxes. It can be a reference for the succeeding years and you can even see if your business is growing or if you’re making a profit.

• Get help

There are now freelancer communities that you can join online. Try joining ones that are for translators so you can easily get help with your taxes and they’ll understand what you are talking about. If you are new to freelancing, you might not have a budget for an accountant right away.

However, if you think that you are really having a hard time doing your taxes, you can always get professional help in the future. Maybe you can also join workshops for freelancers that cover how to handle your taxes. These things can be learned and there are many people out there who can help you out.

Conclusion

Yes, it can be very overwhelming figuring out freelance translation taxes. But, this is just one of the things a freelancer needs to learn to continue enjoying the freelancer lifestyle. Take it one step at a time so that you don’t drown in papers and documents. And again, if you can get help with your freelance translation taxes, do so.

Get Organized & Win More Clients

Kosmo has everything you need to run your freelancing business.