How to Create a Mileage Log for Taxes

Do you need help on how to create a mileage log for taxes? The world of freelancing certainly opens up new tasks, and this is one of them, creating your own mileage log. At first, this can be intimidating and or puzzling, especially if you are used to being employed. Or, you are just fresh out of graduation and went straight to freelancing.

Not to worry as all of this can be sorted out and learned. There may be a couple of helpful fellow freelancers out there who can teach you. (Tip: Try joining a freelancing community!) Being a freelancer is pretty much like running a business, even if you haven’t registered for an LLC, it helps to operate like one.

To keep your business or freelancing lifestyle afloat, you have to make ends meet. Better yet, you need to make a profit. But what some freelancers fail to account for is that there are expenses that come out of working. You can’t just look at how much money you are making from your clients. You also need to list down your expenses, such as operating fees.

It’s a good thing that there are freelancers out there who can utilize a mileage log for taxes. This can help reduce your running costs to keep your business afloat.

What Exactly is a Mileage Log?

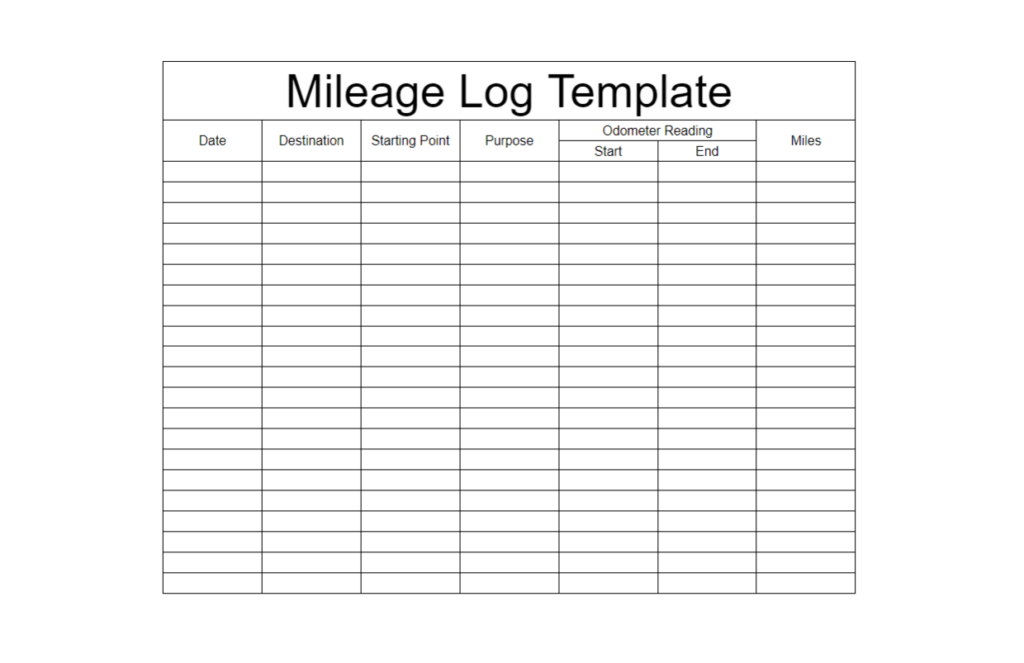

Simply put a mileage log is a record of the usage of your vehicle. However, this is a very meticulous type of recording. You have to input your odometer reading before and after you have used your vehicle. This is to record how many miles you have driven. A mileage log will include important details, such as the date you used your vehicle, the starting point and destination of your trip, and also the purpose.

If you have used your vehicle for work purposes, then you may be eligible to get deductions for your taxes. For example, you are a photographer who has to go to a photoshoot. You bring your car to go to work and you also bring your equipment with you. Maybe the studio is 10 miles, you have to log all of these details to find out how much you can reimburse.

For instance, in some countries, you can get around $0.50 per mile for using your vehicle for business. It may not seem much but 10 miles x $0.50 = $5.00. And it will soon stack up, especially if you use your vehicle for work all the time.

Before You Start Creating a Mileage Log

Now, every freelancer has a different situation. You have to check the rules or the law on how to create a mileage log for taxes depending on where you are currently residing or living. Each country has different rules and definitely different rates on how much you can actually get reimbursed for driving your vehicle for work.

Contact the tax collection agency of your country or visit their website to get more information. Do your research so you don’t waste time and effort learning how to create a mileage log for taxes. Remember that there are different requirements from the agencies and you must meet these to be eligible for reimbursements. Once you have verified all of the necessary information from your country’s tax collection agency, then you can start.

Creating a Mileage Log for Taxes

If you take everything one step at a time it will be easier to learn how to create a mileage log for taxes.

- First things first, choose your logging medium of choice. This can be anything you are more comfortable with. it can be Google Sheets or Excel Sheets. There are others who prefer to write things down. You can even use the template above to help you out.

- Next, learn the required details for mileage log taxes. Again, this can differ from one tax collection agency to another. But, some of the most common details required apart from those already on the sheet are indicated below:

- Car make – What type of vehicle are you using, be specific with the brand and the model. Don’t forget to include the vehicle model’s year.

- Coverage period – Do include the start date; fairly common is the beginning of the year or the start of the tax period.

- Total Miles – Fill this out once your coverage period has ended

- Total Reimbursement – To make things easier for you and the tax collection agency, you can write down the total reimbursement. Just make sure that you use the correct formula or rate when computing this.

- Finally, make sure to use your mileage log taxes every time you use your vehicle. Sometimes you are rushing to make your gigs and you fail to check your odometer. This won’t do as you won’t be able to create a proper mileage log. Make it a habit to always check and write down what is on your odometer before getting into the car and before getting out.

Tips for Keeping Your Mileage Log Updated

Maybe you have trouble writing down your mileage every now and then. Definitely, it needs some getting used to. But, learning how to create a mileage log for taxes and sticking to it can be very beneficial. Below are a few tips to help you out:

• Use a Satellite Navigation Software

Before heading out, it’s now fairly common to rely on apps like Waze or Google Maps. When you input your destination, it will show how far your destination is. This can help you remember to put down details for your mileage log. If there is a function to save all of your trips, this can help when filling up your form.

• Take a Pic

Not a fan of notetaking? Then use your phone. These days, you can take a picture of anything you need to be reminded of. Just take a quick pic of your dashboard while your engine is heating up. Then be sure to snap another photo before you move to your next destination or head back home.

• Get a Tracker

There are now apps that are developed for the specific purpose of creating mileage logs. You can utilize these to make your life easier. Better yet, check out apps that can offer computations for your tax reimbursements, too.

Why Create Mileage Logs?

You might be thinking that creating a mileage log for taxes is just another task on your list. However, this can actually help you with your business. It can even help you get a better handle on your car as vehicle mileage can say a lot about its state or life.

Aside from saving you money in the long run, learning how to create a mileage log for taxes can even be helpful to the environment. You can be more aware of your expenses as well as your carbon emissions.

Another thing about learning how to create a mileage log for taxes is it can be another freelancing gig for you. There might be a client out there who needs help with their own mileage log.

Conclusion

Learning how to create a mileage log for taxes offers many benefits for you. Again, it may not seem much, a few cents here and there but it all adds up. For freelancers, every penny counts, whether it be from earning money or saving money. So, go ahead and take advantage of using a mileage log for taxes, it doesn’t really cost anything to keep track of how many miles you have driven.

Get Organized & Win More Clients

Kosmo has everything you need to run your freelancing business.