What Is An Invoice?

As a freelancer, you’ve probably heard about invoices. But what exactly is an invoice? And why is it so important in your line of work? Through this blog post, we aim to demystify the concept of an invoice, and shed light on its significance in the world of freelancing.

There’s a common misconception among freelancers that invoices are complex and difficult to understand. This couldn’t be further from the truth. In reality, an invoice is a simple yet powerful tool that is crucial for the smooth operation of your freelance business.

Understanding invoices is not just about getting paid. It’s about legitimizing your work, keeping track of your earnings, and making sure you’re prepared during tax season. Let’s start by going back to the basics and defining what an invoice is.

Understanding the Basics of an Invoice

An invoice, put simply, is a document sent by a provider of a product or service to the purchaser. The invoice establishes an obligation on the part of the purchaser to pay, creating a record of the sale.

It serves as a sort of ‘bill of sale’, detailing the transaction between you and your client. This includes what services were rendered, how much is owed, and when the payment is due.

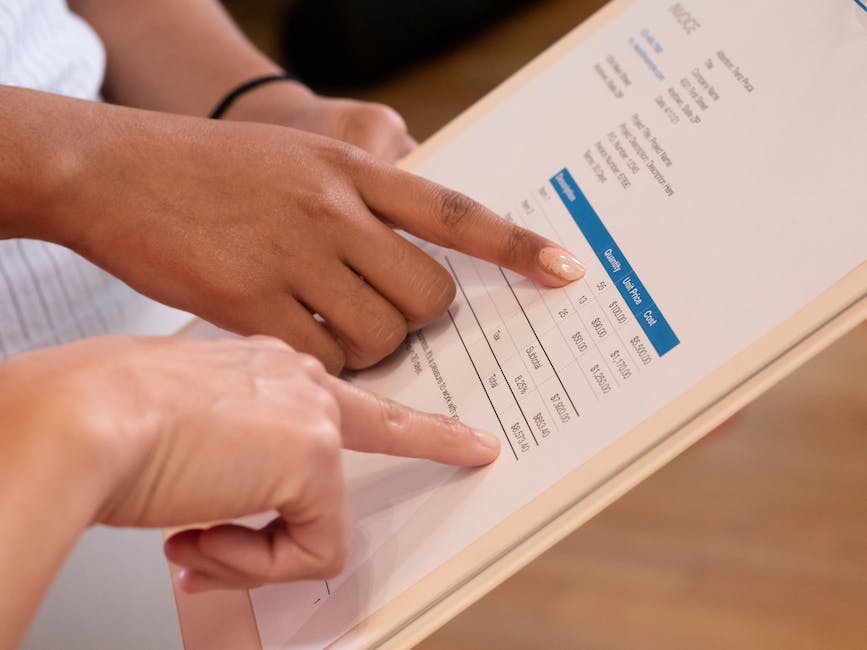

The basic components of an invoice include the date of the invoice, your details (as the service provider), your client’s details, a detailed list of services rendered, the total amount due, and the due date for payment.

Importance of an Invoice for Freelancers

So, why are invoices so important for freelancers? Well, for starters, they legitimize the work you do. They serve as proof that a service was rendered and a payment is due. This is particularly important when dealing with new clients or large projects.

Invoices also play a significant role in securing payment. By detailing the services rendered and the amount due, they provide a clear and concise breakdown of what the client is paying for. They also establish a timeline for when payment is expected.

Lastly, invoices help you keep track of your earnings. As a freelancer, it’s essential to have a record of every transaction for tax purposes. Not only does this make tax season easier, but it also provides a clear picture of your financial health, helping you plan and budget effectively.

Elements of a Good Invoice

What differentiates a standard invoice from a good one? The answer lies in its comprehensibility, completeness, and professionalism. A good invoice not only demands payment but also communicates your professionalism to your clients. So, what are the key components that every invoice should have? Let’s explore.

Freelancer’s Details

First and foremost, your invoice should clearly indicate who it’s coming from, which is you. Including your correct and complete contact information is crucial. This should cover your name or business name, address, phone number, and email address. Why is this important?

Well, for starters, it establishes your credibility. A professional-looking invoice, complete with all your details, gives your clients confidence in your services. Secondly, it provides a point of contact for any clarifications or disputes. If a client has a question or concern about the invoice, they know exactly how to reach you.

The key takeaway here? Never underestimate the power of clear and comprehensive contact information on your invoice. It’s more than just a formality; it’s a tool for effective communication and dispute resolution.

Client’s Details

Just as your details are important, so are the client’s. An invoice should always include the client’s correct and complete information. This covers their name or company name, address, and if possible, the contact person’s name, especially for larger organizations.

This serves a dual purpose. Firstly, it ensures the invoice reaches the right person or department, thereby speeding up the payment process. Secondly, it helps in maintaining clear records of whom you have provided services to, which can be useful for future reference.

Remember, a mix-up in the client’s details can lead to delayed payments or even non-payments, so always double-check these details.

Breakdown of Services Rendered

Now, let’s get to the heart of the invoice – the breakdown of services rendered. This is where you list out what services you have provided, how much time you spent on them, and your rate.

Why is this important? It brings transparency to your billing process. The client can see exactly what they are being charged for, which helps avoid disputes and ensures you get paid for all the work you’ve done.

So, be clear, comprehensive, and detailed when listing out your services. And remember, ambiguity is the enemy of payment. The more clearly you list your services, the less room there is for confusion or dispute.

Different Types of Invoices

Just as there are different types of freelancing work, there are also various types of invoices that freelancers might use. Each type serves a unique purpose and is used under different circumstances. Understanding these types will help you choose the most appropriate one for your business needs.

Standard Invoice

A standard invoice is the most common type. It’s a straightforward bill, itemizing the services you’ve provided and the amount due. It’s the go-to invoice for most freelancers.

Proforma Invoice

Have you ever given a client an estimate of the cost before you start a project? That’s a Proforma Invoice. It’s not a demand for payment, but rather an agreed-upon statement of the expected cost.

Credit Invoice

A Credit Invoice is used when you need to provide a refund or discount to your client. It’s essentially a way of saying you owe the client, not the other way around.

How to Create an Invoice

Now that you’re familiar with the types of invoices, let’s take a look at how to create one. While it might seem daunting at first, creating an invoice is actually straightforward once you know the steps.

First, choose your invoicing method. This could be as simple as using a Word or Excel template, or you could use an online invoicing software. These online platforms often come with additional tools to help you manage and track your invoices.

Next, fill in your details and your client’s details. Be sure to include your name, address, contact information, and any other relevant information. Do the same for your client.

Now, itemize the services you’ve provided. Be specific and clear, including the rate for each service and the total cost. Finally, specify the payment terms, such as the due date and the methods of payment you accept.

The Process of Invoicing

Invoicing is more than just creating and sending an invoice. It’s a process that involves several steps, from the moment you start a project to when you receive payment.

After creating your invoice, you send it to your client. This can be done through email or through an online invoicing platform. The client then has a certain period (usually 30 days) to make the payment.

But what happens if a client doesn’t pay on time? Late payments can be a significant issue for freelancers. It’s important to have a plan in place to handle these situations. You might start with a gentle reminder, then move on to a more formal demand if necessary. In extreme cases, you might need to consider legal action.

Remember, your invoice is a reflection of your professionalism. Make sure it’s accurate, clear, and punctual. This not only helps ensure you get paid, but it also contributes to a positive working relationship with your clients.

Legal Aspects of Invoicing

If you’ve ever wondered about the legal implications of invoicing, you’re not alone. Many freelancers, especially those just starting out, may not be aware of the legality surrounding invoices. An invoice is not just a request for payment—it serves as a legal document as well. This means that it can be used as evidence in court if a dispute arises between you and your client over payment.

From a tax perspective, invoices are crucial. They are a record of your income, which you’ll need when it’s time to file your taxes. They can also serve as proof of expenses if you’re running a business and need to claim certain costs.

Therefore, it’s important to keep copies of all the invoices you issue. You never know when you might need them for legal or tax purposes. It’s also good practice to keep a record of your clients’ payment confirmations for the same reasons.

Mistakes to Avoid When Invoicing

While invoicing is a crucial part of freelancing, it’s not uncommon for freelancers to make mistakes in the process. But don’t worry, we’ve got you covered. Let’s look at some of the common mistakes and how you can avoid them.

One of the biggest mistakes you can make is not including all the necessary information on your invoice. A good invoice should clearly state your contact details, the client’s contact details, a detailed breakdown of the services provided, the total amount due, and the due date for payment.

Another common mistake is not being clear about payment terms. Always specify the due date for payment. If you have a late payment fee, make sure to include this on the invoice as well. This can help encourage clients to pay on time.

Lastly, many freelancers forget to number their invoices. Each invoice you issue should have a unique number. This makes it easier for you and your client to keep track of invoices and payments.

Conclusion

Understanding invoicing is a fundamental part of freelancing. It not only helps you get paid on time but also serves as a legal document and a record for tax purposes. By avoiding common mistakes and implementing the best practices discussed in this blog post, you can ensure that your invoicing process is efficient and effective.

Remember, the key to successful invoicing is clarity and organization. So, why not start implementing these practices today and see the difference it makes in your freelancing career?

Get Organized & Win More Clients

Kosmo has everything you need to run your freelancing business.