Invoicing Software for Accountants

Revolutionize your accounting game and accelerate payments with Kosmo. In just a few clicks, send invoices in a flash, monitor payment progress, and maintain a strong hold on your financial management.

Invoicing for Accountants with Kosmo

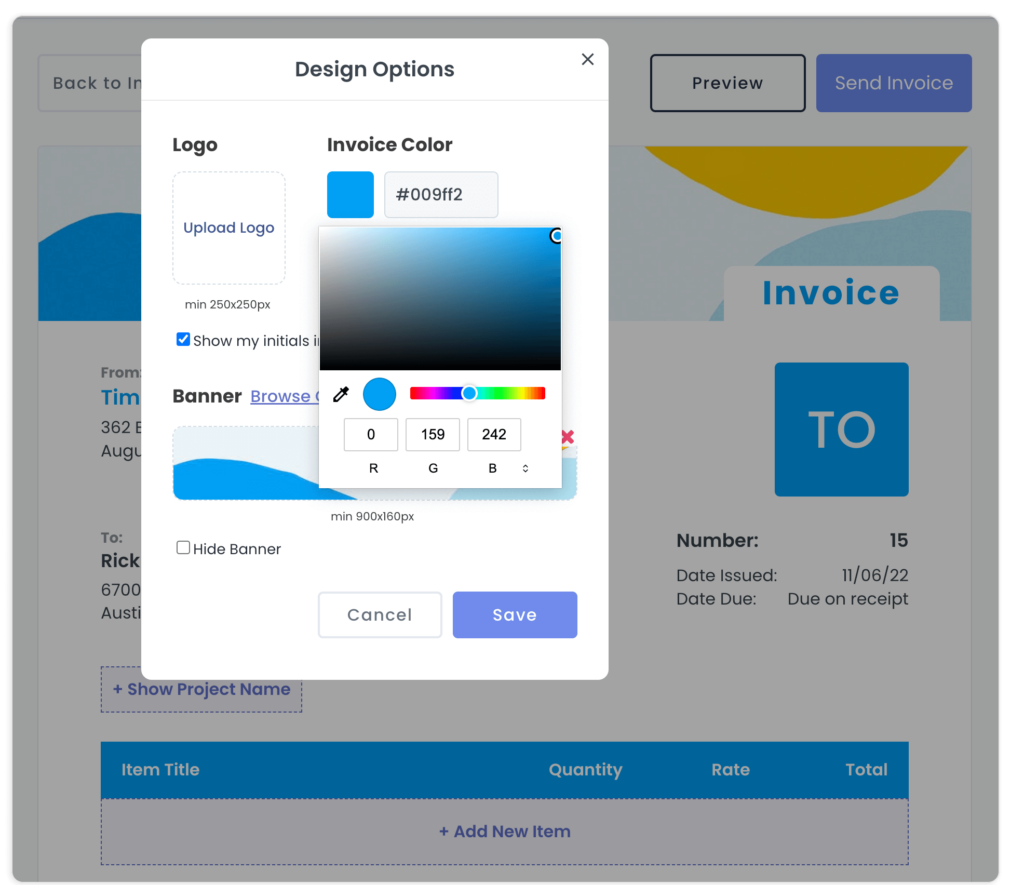

Effortlessly streamline invoicing for your accounting business with Kosmo’s powerful invoicing tools. Kiss organizational chaos goodbye as you easily create professional, customizable invoices with your own logo and banner. Say goodbye to manual data entry, as previously tracked time is automatically incorporated into invoices – eliminating errors and saving you precious time. Plus, effortlessly add items to invoices with clear descriptions, ensuring your clients know exactly what they’re paying for – a vital aspect for maintaining transparency and trust in the world of accounting.

Beyond invoicing, Kosmo’s intuitive client management capabilities empower you to keep all your important client information in one central location. But that’s not all – our game-changing platform goes above and beyond to support your end-to-end accounting business management needs. With integrated proposal and contract management tools, elegant project management, seamless expense tracking, and streamlined payment processing, Kosmo has your back, allowing you to focus on what matters most – providing top-notch accounting services to your clients. So, why wait? Elevate your accounting practice to new heights with Kosmo today.

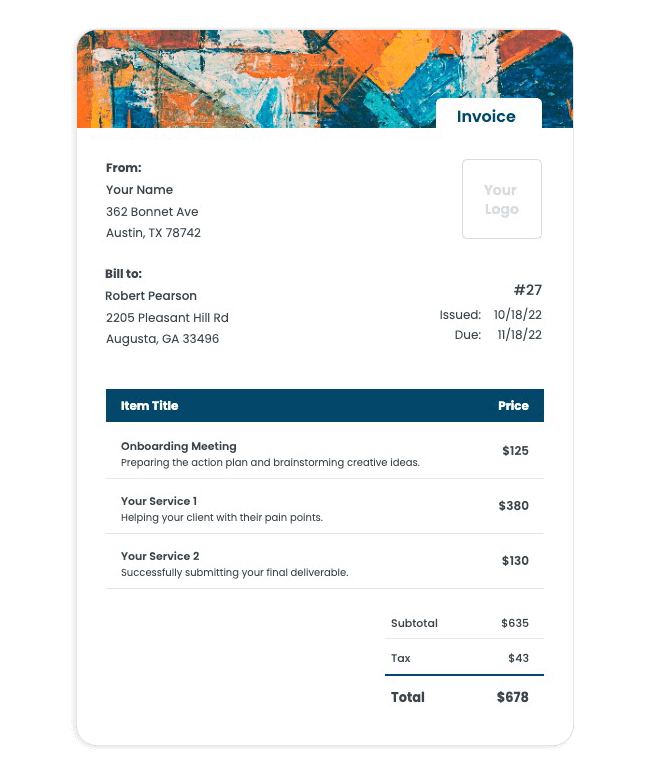

Create Professional Looking Invoices

Design invoices that match your brand and style. With Kosmo, you can customize your invoices with your logo, banner and colors.

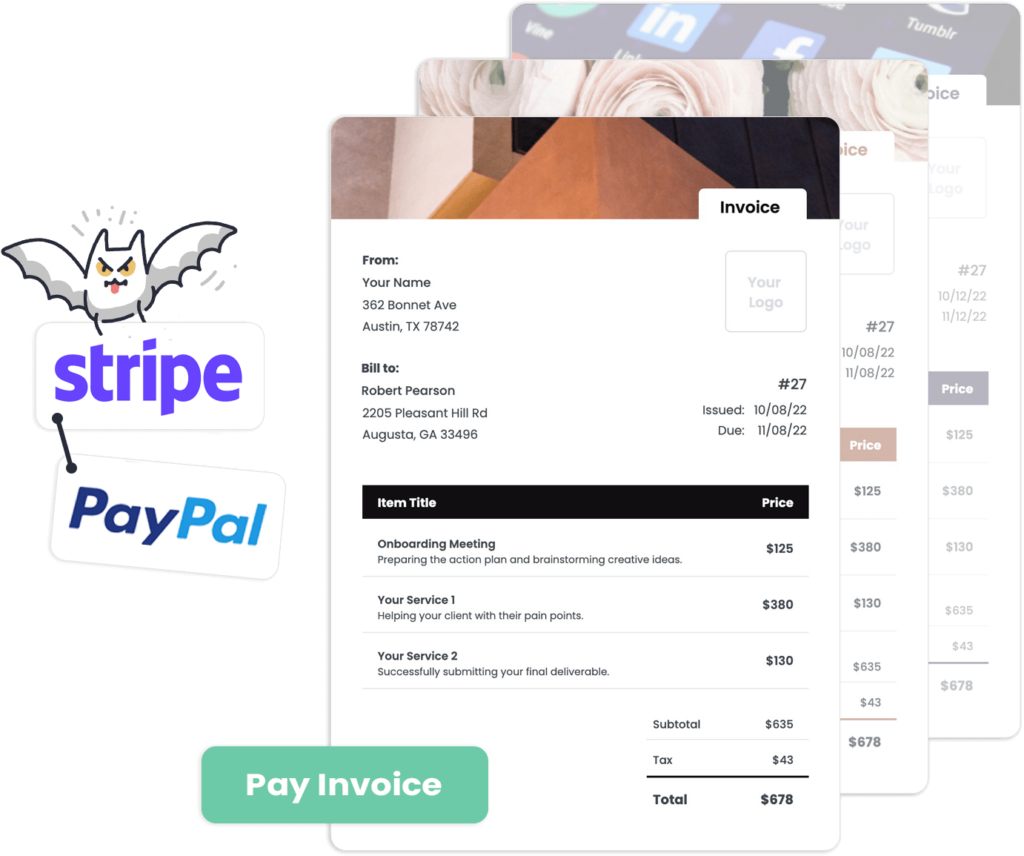

Get Paid Faster Via Credit Card and ACH

No more waiting for checks. Get paid via credit card and ACH. Kosmo also keeps track of all your payments in one place.

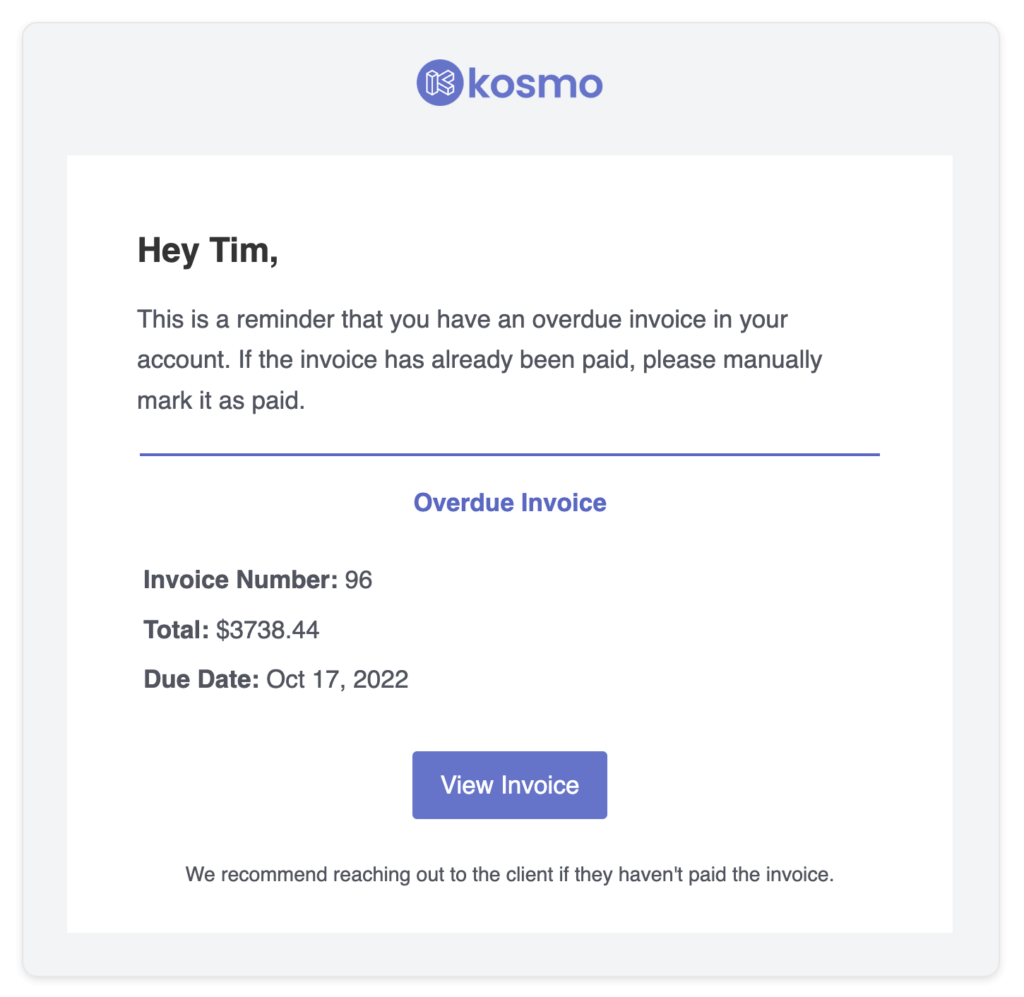

Never Forget About an Invoice

With automatic reminders, you’ll always know when a payment is due. Stay on top of your finances and get paid on time, every time.

Why Do Accountants Need Invoicing Software?

The necessity of invoicing software for accountants can be boiled down to two primary reasons: improving efficiency and enhancing client satisfaction. In a profession that revolves around managing finances and ensuring accuracy, accountants benefit greatly from automating the invoicing process. It helps them save valuable time and minimize manual errors, allowing them to focus on more important tasks, such as financial analysis and strategic planning.

Additionally, invoicing software provides accountants with a plethora of features that can elevate their services, such as customized invoicing templates, integrated payment gateways, and timely payment reminders. As a result, clients enjoy timely, clear, and professional invoices which ultimately improve clients’ payment habits and satisfaction. Investing in invoicing software is a strategic move for accountants aiming to streamline their operations and build lasting relationships with clients.

What Are The Benefits?

Invoicing software offers numerous benefits for accountants, streamlining daily tasks and improving overall efficiency. One of the primary advantages is time-saving, as modern invoicing software automates repetitive tasks such as generating and sending invoices, managing client information, and tracking payments. This automation frees up more time for accountants to focus on higher-level tasks, ultimately enhancing productivity.

Another key benefit is the improvement in accuracy. Invoicing software minimizes the risk of human error, reducing the chances of costly mistakes and discrepancies. Furthermore, the software usually includes features for tracking tax compliance, ensuring that businesses stay up-to-date with the latest regulations. Not only does this save time, but it also reduces the likelihood of penalties from tax authorities.

Invoicing software also helps accountants maintain better financial organization by offering powerful reporting and analysis features. Accountants can access detailed information about outstanding invoices, evaluate the efficiency of their billing process, and make informed decisions based on comprehensive financial data. Additionally, most invoicing platforms support integration with other financial software, streamlining the workflow and maintaining consistency across different tools and processes. This seamless integration allows accountants to track and analyze their business’s financial health more effectively, ensuring long-term success.

Invoice Templates

Ever wondered how to craft an invoice that secures your payments swiftly? Look no further, as Kosmo makes the whole process effortless, providing you with stunning, professional invoices tailored to your freelancing needs.

Just pick your favorite invoice template from our free selection, customize it with your individual branding, and ensure you incorporate all the key info like payment terms and contact details. Embrace the digital era by sending your invoice online and expedite your payments with automatic late payment reminders – accountants will definitely appreciate it!

Get paid on time,

every time.

Create professional invoices with Kosmo and level up your business today.

What payment options work with Kosmo?

Kosmo offers a variety of payment options to cater to the diverse needs of its users. The platform integrates seamlessly with popular payment gateways such as Stripe and PayPal. This allows users to process payments with ease and security, as both of these services accept all major credit and debit cards.

In addition to the standard options provided by Stripe and PayPal, Kosmo also allows users to add custom payment methods. This flexibility ensures that businesses using Kosmo have the ability to accommodate their specific preferences and requirements, making it an effective solution for managing and processing payments.

Does this really save time?

Invoicing software streamlines the billing process for accountants, making it more efficient and freeing up valuable time for other tasks. By automating repetitive tasks such as data entry, tracking payments, and sending reminders, this software reduces the likelihood of human error and allows accountants to focus on more strategic financial management activities.

Additionally, modern invoicing software often comes with robust integrations, allowing accountants to sync financial data across multiple platforms and applications, further simplifying their workflow. This reduces the need to manually input or transfer information, resulting in faster invoicing and payment processing, and improving overall cash flow management for their clients.

Who should use invoicing software?

Invoicing software isn’t just for major enterprises – it’s beneficial for a wide range of businesses and freelancers. Small business owners, particularly those who are self-employed or managing a growing team, find invoicing software invaluable. It streamlines the billing process, ensures timely payments, and can help business owners keep a closer eye on their finances, ultimately saving time and reducing stress.

In addition to small business owners, freelance professionals such as writers, designers, artists, and consultants can greatly benefit from invoicing software. Freelancers depend on timely payments to maintain steady cash flow, making organization and accuracy in invoicing crucial. Invoicing software simplifies this process by providing an easy way to create professional invoices, track payments, and manage expenses, allowing freelancers to focus on their work instead of chasing payments.