Invoicing Software for Financial Advisors

Speed up your invoicing and cash flow as a financial advisor. Kosmo allows you to effortlessly send invoices, monitor payments, and keep your financials neat and organized.

Invoicing for Financial Advisors with Kosmo

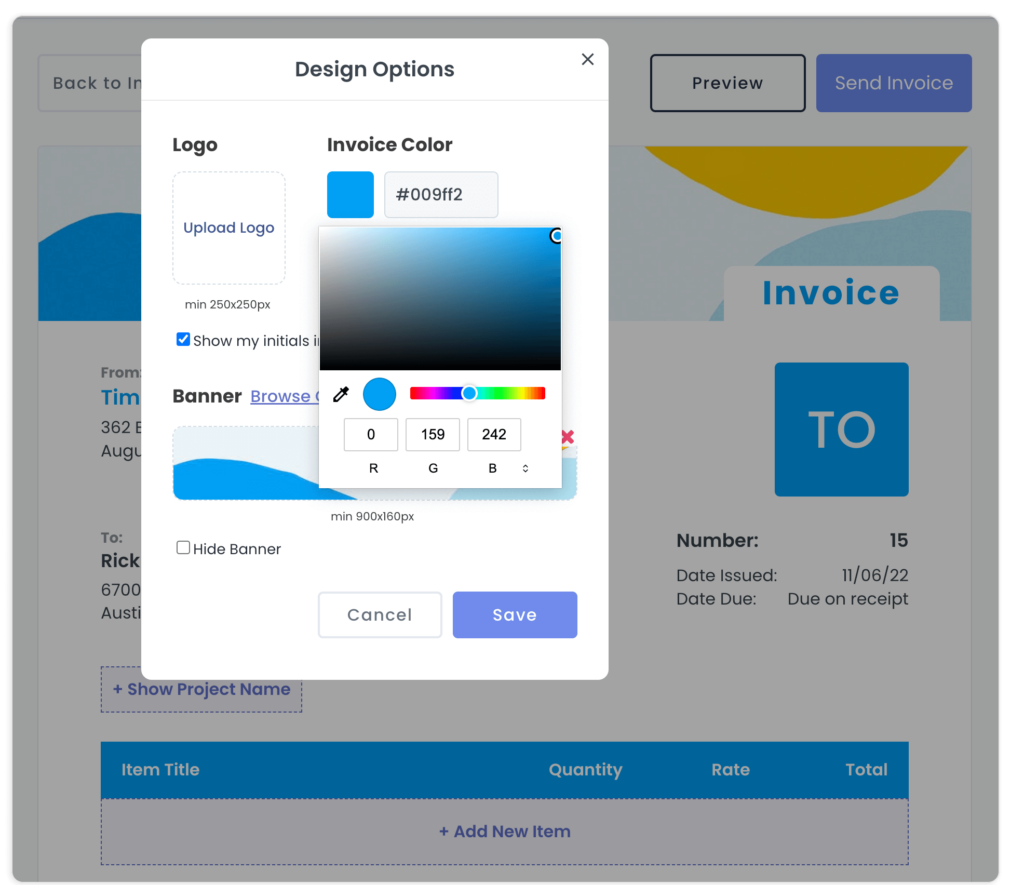

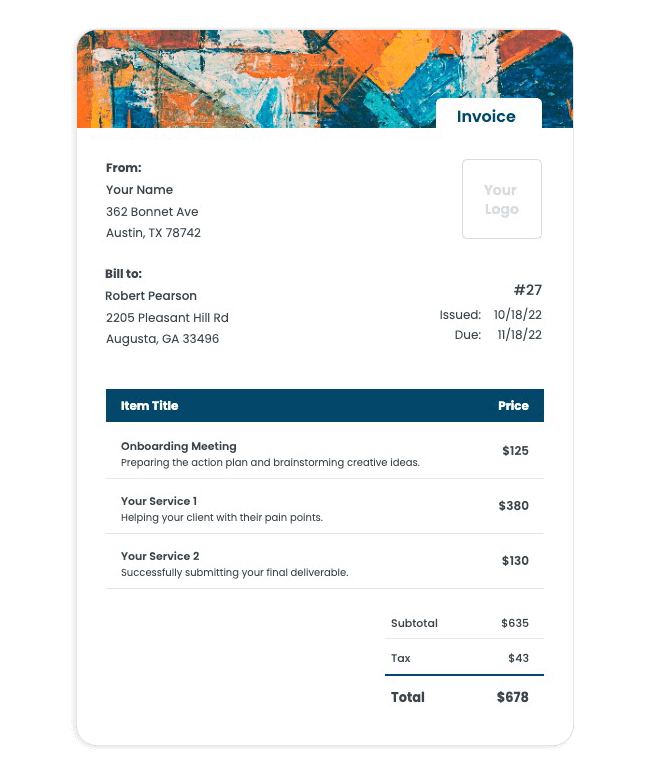

Efficient invoicing plays a crucial role in the world of Financial Advisors, ensuring timely payments and maintaining healthy client relationships. Kosmo understands this importance and offers a seamless invoicing process tailored to the specific needs of Financial Advisors. With customizable invoices featuring your own logo and banner, you can project a professional image and strengthen your brand as you get paid for your valuable financial guidance.

What sets Kosmo apart is its integration of invoicing with other essential tools to maximize your productivity as a Financial Advisor. Automatically add previously tracked time and assigned expenses to your invoices for comprehensive and accurate billing. This, in conjunction with Kosmo’s proposal and contract management tools, as well as payment processing features, creates a one-stop solution for managing your financial advisory business. Say goodbye to juggling multiple software systems and focus on what you do best – empowering your clients with wise financial decisions and strategies.

Create Professional Looking Invoices

Design invoices that match your brand and style. With Kosmo, you can customize your invoices with your logo, banner and colors.

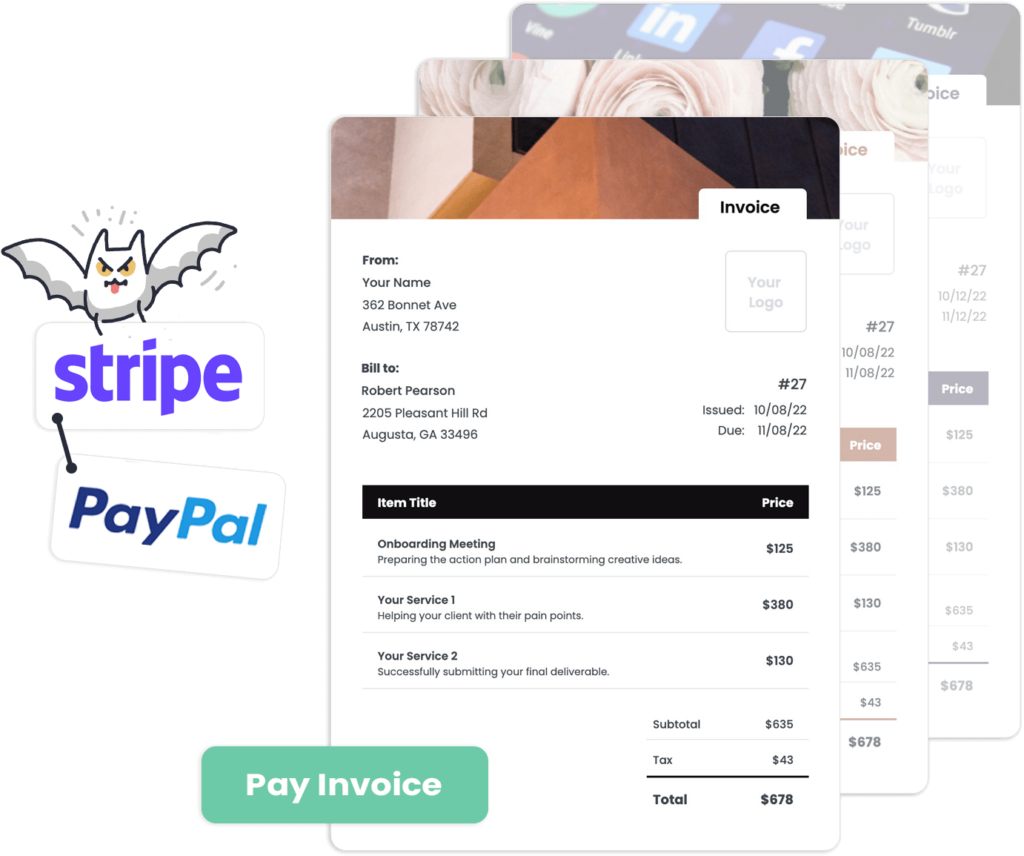

Get Paid Faster Via Credit Card and ACH

No more waiting for checks. Get paid via credit card and ACH. Kosmo also keeps track of all your payments in one place.

Never Forget About an Invoice

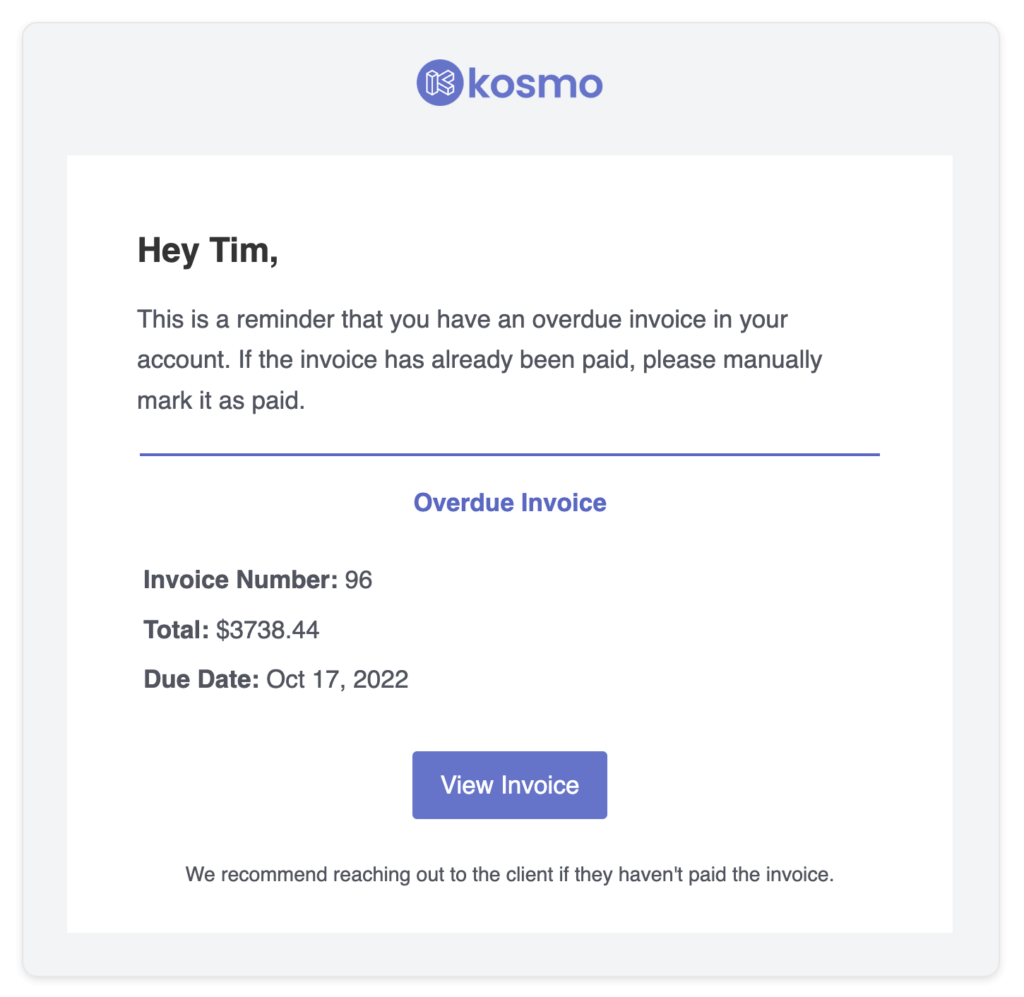

With automatic reminders, you’ll always know when a payment is due. Stay on top of your finances and get paid on time, every time.

Why Do Financial Advisors Need Invoicing Software?

Invoicing software significantly streamlines financial advisors’ day-to-day workload by automating and organizing their billing processes. As professionals who deal with diverse clientele and complex financial tasks, advisors can greatly benefit from the efficiency and accuracy that such software solutions provide. This enhanced efficiency enables them to allocate more time to managing their clients’ financial needs and expanding their practice.

Moreover, invoicing software helps financial advisors maintain greater transparency with their clients by providing clear, detailed, and professional invoices. In an industry where trust and credibility are vital, having organized and accurate billing records can help reinforce clients’ confidence in their chosen advisor. Overall, incorporating invoicing software into a financial advisor’s toolkit is a prudent decision that results in time savings, accuracy, and enhanced client relationships.

What Are The Benefits?

Invoicing software offers numerous benefits for financial advisors, streamlining their daily operations and enhancing client relationships. One significant advantage is the automation of recurring invoices and payment reminders, which can save time, reduce errors, and ensure timely payments. This efficiency allows financial advisors to focus on their core activities, such as providing sound financial guidance and building their client base.

Another benefit is the ability to generate professional and customizable invoices that reflect the financial advisors’ branding and identity. Invoicing software typically features a variety of templates, which can accommodate diverse client needs and preferences. By offering polished and personalized invoices, financial advisors can enhance their professional image and ensure clear communication with their clients.

Lastly, invoicing software often includes robust reporting and analytics tools that empower financial advisors to make informed decisions about their business’s overall financial health. These features enable advisors to track vital metrics, such as outstanding payments, revenue trends, and client payment habits, with just a few clicks. This valuable information can help them identify patterns and quickly address issues that might impact their business’s growth and success.

Invoice Templates

Eager to craft an invoice that ensures timely payment for your financial advisory services? Kosmo makes it a breeze to generate elegant, professional invoices catering to your freelancing requirements.

Simply pick a complimentary invoice template from our collection, personalize it with your branding, and incorporate vital information like your payment terms and contact details. Share your invoice online and expedite the payment process with automated reminders for overdue payments.

Get paid on time,

every time.

Create professional invoices with Kosmo and level up your business today.

What payment options work with Kosmo?

Kosmo offers users flexibility when it comes to processing payments, making it an ideal option for businesses looking to simplify transactions. The platform seamlessly integrates with leading online payment service providers, such as Stripe and PayPal. This means that users can accept a wide range of payment methods, including credit cards and debit cards, all through a single, user-friendly interface.

Additionally, Kosmo allows for the inclusion of custom payment options, giving businesses the opportunity to tailor payment processes to fit their unique needs. This versatility ensures that Kosmo can accommodate various business models, making it an appealing choice for many companies seeking streamlined payment processing solutions.

Does this really save time?

Invoicing software is a game-changer for financial advisors in their quest to save time and optimize productivity. It automates many labor-intensive tasks, such as creating, organizing, tracking, and processing invoices. By eliminating manual data entry and reducing the risk of human errors, financial advisors can reduce the time spent on administrative tasks and focus on more strategic initiatives, ultimately providing better services to their clients.

Additionally, invoicing software streamlines communication between financial advisors and their clients by offering seamless invoicing and payment solutions. Clients can effortlessly view, pay, and track their invoices, all in one place. This not only saves time for the advisor but also enhances the client-advisor relationship, fostering trust and confidence through efficient and transparent invoicing processes. Ultimately, adopting invoicing software simplifies daily tasks, allowing financial advisors to focus on what really matters – helping their clients achieve financial success.

Who should use invoicing software?

Invoicing software can be a game-changer for a wide range of businesses and freelancers looking to streamline their billing process and improve financial management. Small business owners, including retail shops, restaurants, and creative agencies, can significantly benefit from such tools, as it simplifies the billing process, saves time, and reduces the likelihood of errors. Furthermore, invoicing software often comes with additional features such as expense tracking, payment reminders, and financial reports, making it an essential resource for managing cash flow and maintaining professional bookkeeping practices.

Freelancers and contractors in various industries, from graphic design to consulting, should also consider using invoicing software. As independent workers, they need to manage multiple client engagements and ensure timely payments, often with limited resources. Invoicing software tools simplify the process of creating customized, professional-looking invoices, while also providing the ability to track billable hours, follow up on overdue payments, and monitor their overall financial health. In short, invoicing software provides essential support for these professionals, freeing up time and mental bandwidth for focusing on their work and providing high-quality service.