Invoicing Software for Insurance Agents

Revamp your insurance agency’s invoicing system and accelerate payments coming your way. With Kosmo, effortlessly send invoices to clients in a flash, keep tabs on payments, and stay in control of your financial landscape.

Invoicing for Insurance Agents with Kosmo

Efficient invoicing is a crucial aspect of managing an insurance agency, ensuring timely payments and seamless communication with clients. Kosmo’s easy-to-use platform offers insurance agents a streamlined invoicing process, enabling them to create professional, customized invoices and effortlessly manage their finances. With its intuitive interface, agents can quickly add items, descriptions, and integrate time tracking to obtain accurate billing, saving valuable time that can instead be focused on growing the business.

In addition to the powerful invoicing capabilities, Kosmo supports insurance agents in their client relationship management and project organization. The platform’s client management feature centralizes valuable client data and communication, ensuring vital information is at your fingertips when needed. Plus, with Kosmo’s project management tools, you can efficiently assign tasks, manage expenses, and stay on top of your work breakdown structures. With such a comprehensive solution, insurance agents can effectively manage their business while delivering exceptional service to their clients, all for an affordable price of just $9 per month.

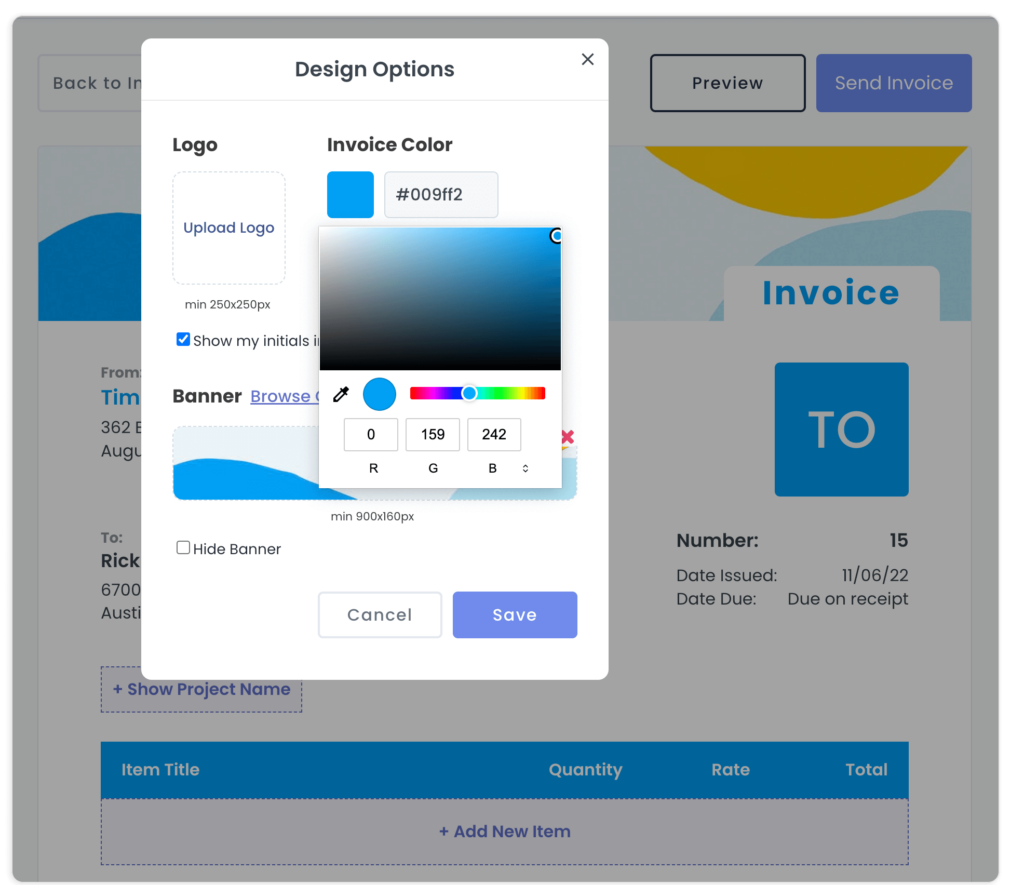

Create Professional Looking Invoices

Design invoices that match your brand and style. With Kosmo, you can customize your invoices with your logo, banner and colors.

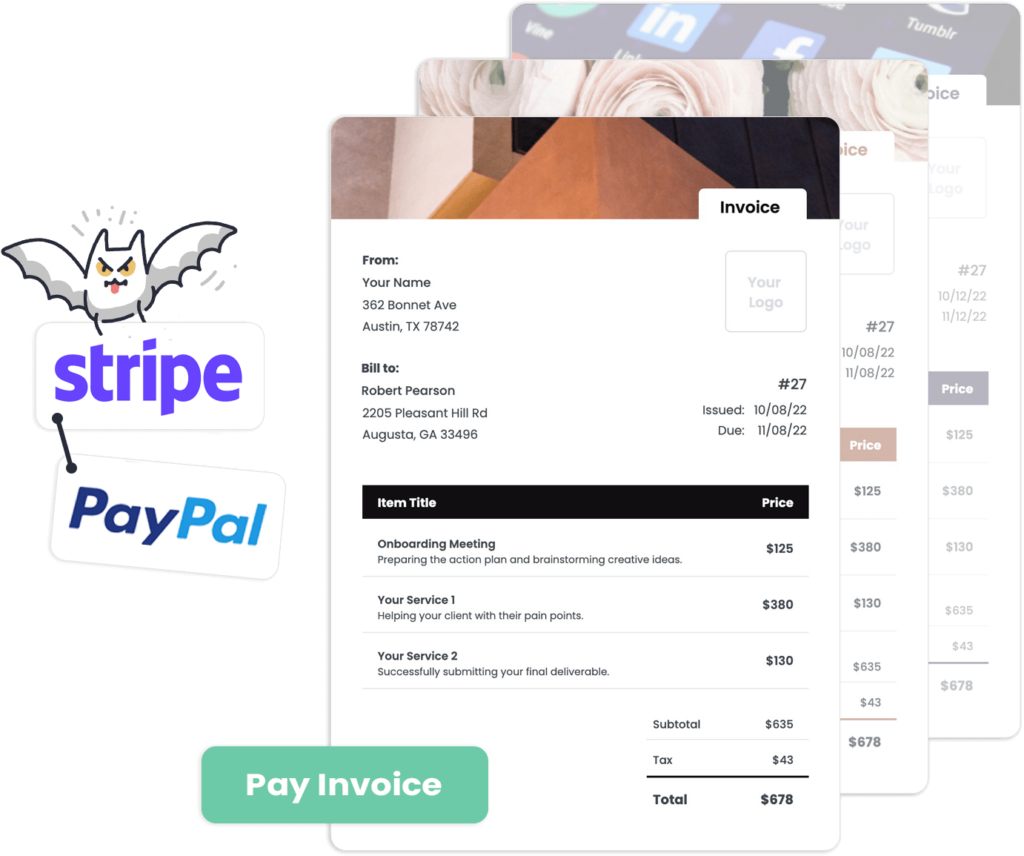

Get Paid Faster Via Credit Card and ACH

No more waiting for checks. Get paid via credit card and ACH. Kosmo also keeps track of all your payments in one place.

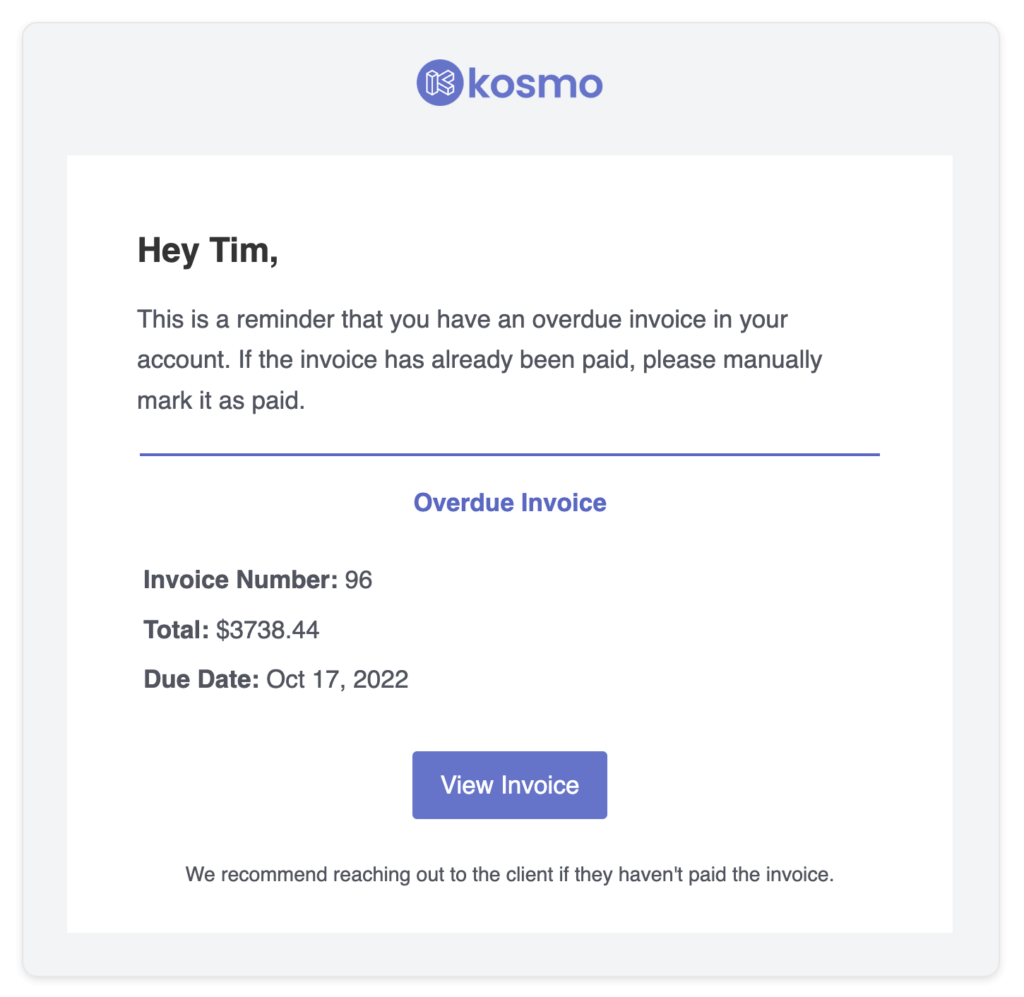

Never Forget About an Invoice

With automatic reminders, you’ll always know when a payment is due. Stay on top of your finances and get paid on time, every time.

Why Do Insurance Agents Need Invoicing Software?

Insurance agents need invoicing software to streamline their billing processes and enhance customer experience. Comprehensive invoicing software helps them to create professional, customized invoices, and track payments efficiently. This eliminates the need for manual calculation, errors, and time-consuming paperwork in issuing invoices to clients. Additionally, it allows insurance agents to maintain organized records of their transactions, ensuring consistency and accuracy in their financial operations.

Invoicing software also allows insurance agents to automate recurring billing, manage multiple currencies, and offer clients a variety of secure payment options. The software’s real-time reporting feature provides valuable insights into their revenue streams, allowing insurance agents to make informed business decisions and monitor financial health. Ultimately, adopting an invoicing software simplifies the administrative workload for insurance agents and aids in maintaining positive relationships with clients by providing a transparent and efficient financial workflow.

What Are The Benefits?

Invoicing software offers significant advantages for insurance agents, streamlining their daily tasks and enhancing the overall client experience. One key benefit is the automation of repetitive tasks. With invoicing software, insurance agents can save time and reduce the risk of errors by automatically generating invoices based on predefined templates and customization options. They can easily track payments, send reminders to clients about outstanding balances, and even integrate with their accounting systems for seamless financial management.

Another advantage of using invoicing software is the improved professionalism and consistency in communication. In the competitive world of insurance, agents need to provide clear, accurate, and visually appealing invoices that demonstrate their commitment to a high-quality customer experience. With invoicing software, insurance agents can create branded invoices, customize them with relevant details, and send them promptly to clients. This not only helps in building trust and loyalty but also aids in maintaining a positive brand image.

Finally, invoicing software can provide valuable insights into an insurance agent’s business performance. By analyzing the data generated from invoicing and payment processes, agents can identify trends, track sales performance, and spot areas that need improvement. These insights can help insurance agents to make informed decisions, optimize their workflows, and ultimately grow their businesses. Overall, invoicing software is an essential tool for insurance agents to stay organized, efficient, and client-focused in a fast-paced industry.

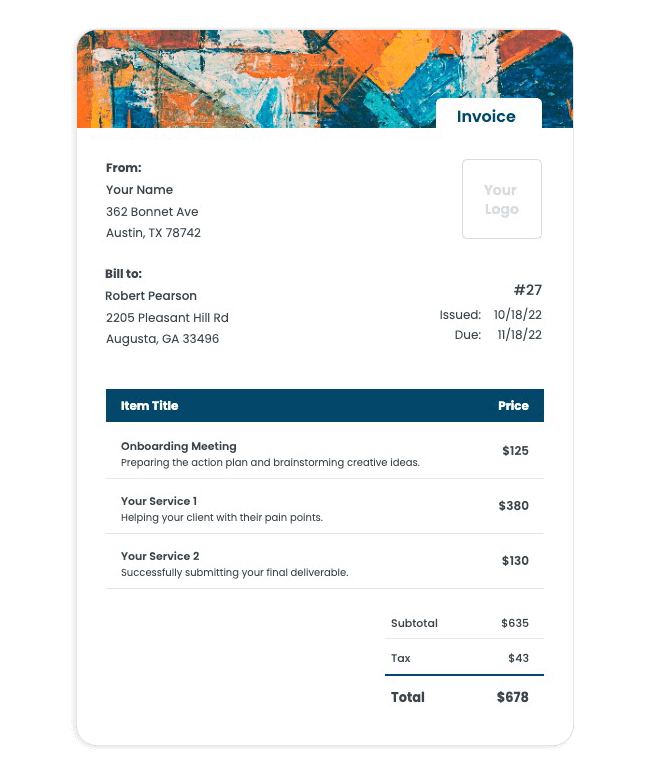

Invoice Templates

Wondering how to create an invoice that ensures timely payments for your Insurance Agents business? With Kosmo, whipping up polished, professional invoices is a breeze, even for busy freelancers like you.

Just pick one of our complimentary invoice templates, inject your own signature style, and plug in all the crucial info, like payment terms and contact details. Send your invoice online and increase your cash flow with automatic late payment reminders. Trust me, it’s a lifesaver for Insurance Agents!

Get paid on time,

every time.

Create professional invoices with Kosmo and level up your business today.

What payment options work with Kosmo?

Kosmo, a user-friendly payment processing platform, offers its users the flexibility and convenience of handling transactions through two popular options: Stripe and PayPal. By integrating these reliable services, Kosmo ensures that both credit and debit card payments can be seamlessly processed for businesses and customers alike.

In addition to Stripe and PayPal, Kosmo accommodates custom payment options for users who prefer a more personalized or specialized payment method. This versatility allows businesses to tailor their payment processing to best suit their specific needs, making Kosmo a valuable tool in streamlining financial transactions.

Does this really save time?

Invoicing software provides numerous time-saving benefits for insurance agents. By automating repetitive tasks, such as generating, sending, and tracking invoices, agents can focus more on building relationships with clients and growing their business. The software often comes with customizable templates that streamline the creation of professional invoices, making it easy for agents to plug in vital information and send it off in just a few clicks.

Another key advantage of invoicing software for insurance agents is its ability to integrate with other essential business tools, such as CRMs, accounting software, and online payment gateways. This seamless integration further cuts down on manual data entry and reduces the likelihood of errors, as information is synced and updated automatically. Additionally, the software helps agents keep track of outstanding payments, offering reminders and notifications for both the agent and the client, thereby expediting the payment process and improving cash flow.

Who should use invoicing software?

Invoicing software is a valuable tool for a range of individuals and businesses seeking efficient ways to manage their billing processes. Freelancers and solo entrepreneurs, for instance, can significantly benefit from these tools as they offer a streamlined way to create, track, and manage invoices. By automating the invoicing process, these individuals can focus on generating income and growing their business, rather than manually handling administrative tasks.

Small to medium-sized businesses (SMBs) also stand to gain from invoicing software. The advanced features provided by some invoicing platforms allow for more accurate tracking of payments, customizable invoices, integration with accounting software, and a better overall customer experience. When transitioning from manual invoicing to utilizing invoicing software, SMBs can expect improved organization, reduced human error, and a more professional look, all while saving time and resources.